As you approach retirement, one of the critical concepts you need to grasp is Required Minimum Distributions, commonly referred to as RMDs. These are mandatory withdrawals that the IRS requires you to take from your retirement accounts, such as traditional IRAs and 401(k)s, once you reach a certain age—currently set at 73 for those born after 1959. The purpose of RMDs is to ensure that you eventually pay taxes on the money you have saved in these tax-deferred accounts.

Understanding how RMDs work is essential for effective retirement planning, as failing to take the required distributions can result in hefty penalties. The calculation of your RMD is based on your account balance at the end of the previous year divided by a life expectancy factor published by the IRS. This means that as your account balance fluctuates, so too will your RMD.

It’s important to note that RMDs do not apply to Roth IRAs during your lifetime, which can be a significant advantage if you are looking to maximize your tax-free growth. However, if you inherit a Roth IRA, RMDs will apply to you. Familiarizing yourself with these rules can help you make informed decisions about your retirement savings and withdrawals.

Key Takeaways

- Understanding RMDs is essential for retirees to avoid penalties and make informed decisions about their retirement accounts.

- Planning for RMDs in retirement involves calculating the required distributions and considering their impact on overall financial plans.

- Utilizing QCDs can provide tax advantages for retirees who want to support charitable causes while meeting RMD requirements.

- Taking advantage of Roth IRA conversions can help manage RMDs and potentially reduce future tax burdens for retirees.

- Coordinating RMDs with other sources of income is crucial for optimizing retirement cash flow and minimizing tax implications.

Planning for RMDs in Retirement

Planning for RMDs is a crucial aspect of your overall retirement strategy. As you prepare for this phase of life, it’s vital to consider how these distributions will impact your cash flow and tax situation. You may want to create a detailed plan that outlines when and how much you will withdraw each year.

This proactive approach can help you avoid surprises and ensure that you have enough liquidity to cover your living expenses while also managing your tax liabilities effectively. One effective strategy is to start planning for RMDs well before you reach the age at which they become mandatory. By doing so, you can assess your overall financial picture and determine how RMDs will fit into your income streams.

This might involve adjusting your investment strategy or reallocating assets to ensure that you have sufficient funds available for withdrawal without jeopardizing your long-term financial goals. Additionally, understanding the timing of your RMDs can help you optimize your tax situation, allowing you to withdraw funds in years when your income may be lower.

Utilizing Qualified Charitable Distributions (QCDs)

If you are charitably inclined, utilizing Qualified Charitable Distributions (QCDs) can be an excellent way to satisfy your RMD requirements while also supporting causes that matter to you. A QCD allows you to donate up to $100,000 directly from your IRA to a qualified charity without having to report the distribution as taxable income. This can be particularly beneficial if you find yourself in a higher tax bracket due to RMDs, as it effectively reduces your taxable income.

In addition to the tax benefits, QCDs can also help you fulfill your philanthropic goals. If you have a specific charity or cause that you are passionate about, making a QCD can be a win-win situation. Not only do you meet your RMD obligations, but you also contribute to a cause that aligns with your values.

It’s essential to ensure that the charity you choose qualifies under IRS guidelines, so consulting with a financial advisor or tax professional can help clarify any questions you may have about this process.

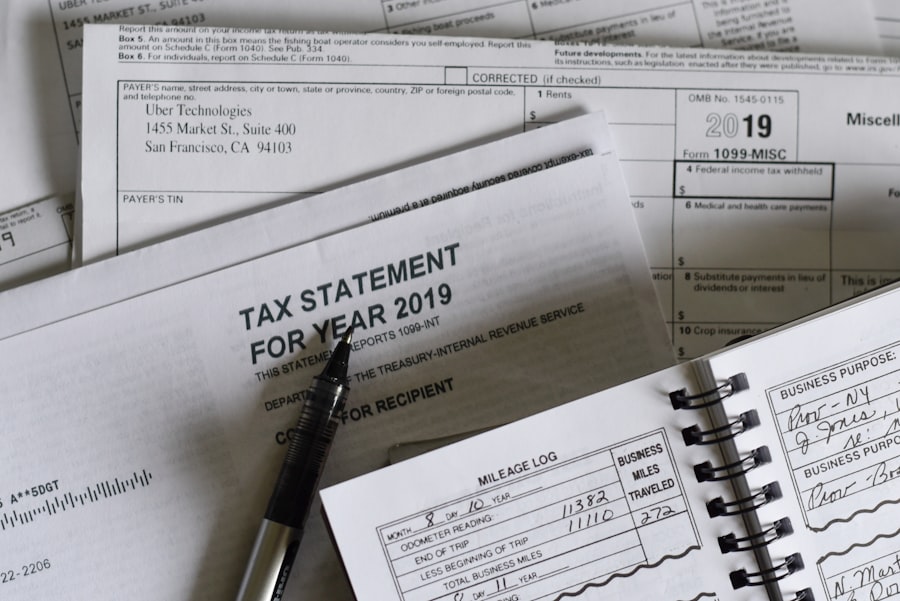

Taking Advantage of Roth IRA Conversions

| Metrics | 2019 | 2020 | 2021 |

|---|---|---|---|

| Number of Roth IRA Conversions | 10,000 | 12,000 | 15,000 |

| Total Amount Converted (in millions) | 500 | 600 | 750 |

| Average Age of Converters | 45 | 47 | 50 |

Another strategy worth considering is converting some or all of your traditional IRA or 401(k) funds into a Roth IRWhile this move may require paying taxes on the converted amount in the year of conversion, it can provide significant long-term benefits. Once the funds are in a Roth IRA, they grow tax-free, and importantly, there are no RMDs during your lifetime. This means that you can allow your investments to grow without being forced to withdraw funds at a certain age.

When contemplating a Roth conversion, timing is crucial. You may want to consider converting during years when your income is lower than usual, as this could minimize the tax impact of the conversion.

As with any financial decision, it’s wise to evaluate your unique circumstances and consult with a financial advisor to determine if this strategy aligns with your overall retirement goals.

Coordinating RMDs with Other Sources of Income

As you navigate retirement, coordinating your RMDs with other sources of income is essential for maintaining financial stability. Your retirement income may come from various sources, including Social Security benefits, pensions, and personal savings. Understanding how these income streams interact with your RMDs can help you create a comprehensive withdrawal strategy that meets your needs while minimizing tax implications.

For instance, if you have other sources of income that are sufficient to cover your living expenses, you might consider delaying your RMDs for as long as possible or withdrawing only the minimum required amount. This approach allows your retirement accounts to continue growing tax-deferred for longer periods. Conversely, if your other income sources are limited, strategically withdrawing more than the minimum required amount from your retirement accounts may be necessary to maintain your desired lifestyle.

Balancing these factors requires careful planning and consideration of both short-term needs and long-term goals.

Considering the Impact of RMDs on Tax Brackets

Understanding how RMDs affect your tax brackets is crucial for effective retirement planning. As you begin taking distributions from your retirement accounts, these withdrawals are considered taxable income and can potentially push you into a higher tax bracket. This is particularly important if you have other sources of income that contribute to your overall taxable income.

To mitigate the impact of RMDs on your tax situation, consider strategies such as timing your withdrawals or utilizing tax-efficient investment strategies. For example, if you anticipate that your income will be lower in certain years, it may be advantageous to take larger distributions during those years when you’re in a lower tax bracket. Additionally, being aware of how RMDs interact with other income sources can help you make informed decisions about when and how much to withdraw from your retirement accounts.

Exploring Long-Term Care Insurance Options

As part of comprehensive retirement planning, exploring long-term care insurance options is essential for protecting yourself against potential healthcare costs in later years. While RMDs focus on managing withdrawals from retirement accounts, long-term care insurance addresses a different aspect of financial security—ensuring that you have coverage for potential medical needs as you age. Long-term care insurance can help cover expenses related to assisted living facilities, nursing homes, or in-home care services.

By securing this type of insurance early on, you can alleviate some of the financial burdens associated with healthcare costs in retirement. Additionally, having long-term care insurance may allow you to preserve more of your retirement savings for other purposes rather than depleting them for medical expenses.

Consulting with a Financial Advisor or Tax Professional

Navigating the complexities of RMDs and their implications on your overall financial plan can be daunting. This is where consulting with a financial advisor or tax professional becomes invaluable. These experts can provide personalized guidance tailored to your unique situation and help you develop strategies that align with both your short-term needs and long-term goals.

A financial advisor can assist in creating a comprehensive retirement plan that considers all aspects of your financial life, including investments, withdrawals, and tax implications. They can also help you understand the nuances of RMD rules and regulations and how they apply specifically to your circumstances. By working with professionals who specialize in retirement planning and taxation, you can make informed decisions that enhance your financial security during retirement.

Implementing Tax-Efficient Withdrawal Strategies

Implementing tax-efficient withdrawal strategies is essential for maximizing the longevity of your retirement savings while minimizing tax liabilities.

For instance, withdrawing from taxable accounts before tapping into tax-deferred accounts like traditional IRAs can help manage your overall tax burden.

Additionally, consider using strategies such as “bucket” approaches or systematic withdrawals tailored to different time horizons and tax implications. By segmenting your investments based on when you’ll need access to them and their associated tax consequences, you can create a more efficient withdrawal strategy that aligns with both your cash flow needs and tax planning goals.

Reviewing Beneficiary Designations and Estate Planning

As part of effective retirement planning, regularly reviewing beneficiary designations and estate planning documents is crucial. Your beneficiary designations dictate who will inherit your retirement accounts upon your passing and can significantly impact their financial future. Ensuring that these designations align with your current wishes is essential for avoiding potential disputes or complications down the line.

In addition to reviewing beneficiary designations, consider how RMDs may affect your estate planning strategy overall. For instance, if you’re leaving behind significant assets in traditional IRAs subject to RMDs, it’s important to communicate this information clearly within your estate plan. Working with an estate planning attorney can help ensure that all aspects of your plan are cohesive and reflect your intentions regarding both asset distribution and tax implications.

Staying Informed About Changes in RMD Rules and Regulations

Finally, staying informed about changes in RMD rules and regulations is vital for effective retirement planning. The IRS periodically updates its guidelines regarding RMDs, including age thresholds and calculation methods. Being aware of these changes allows you to adjust your withdrawal strategies accordingly and avoid potential penalties.

You can stay informed by subscribing to financial news outlets or consulting with professionals who specialize in retirement planning and taxation. Regularly reviewing IRS publications related to retirement accounts will also keep you updated on any new developments affecting RMDs. By remaining proactive about changes in regulations, you’ll be better equipped to navigate the complexities of retirement planning and make informed decisions that align with your financial goals.

To effectively minimize the tax burden associated with Required Minimum Distributions (RMDs), it’s crucial to explore various strategies that can help manage these mandatory withdrawals from retirement accounts. One insightful resource that delves into this topic is an article on Explore Senior Health, which provides comprehensive guidance on how to navigate RMDs and potentially reduce the associated taxes. For more detailed information, you can read the full article by visiting Explore Senior Health. This article offers valuable tips and strategies that can be beneficial for retirees looking to optimize their retirement income and minimize tax liabilities.

WATCH THIS! 👴The RMD Trap That Steals Your Medicare Savings (Hidden Tax on Seniors Exposed)

FAQs

What is RMD and why is it important to minimize the tax burden?

RMD stands for Required Minimum Distribution, which is the minimum amount that must be withdrawn from a retirement account each year once the account holder reaches a certain age (usually 72 for most retirement accounts). Minimizing the tax burden on RMDs is important because the distributions are generally subject to income tax, and larger distributions can push retirees into higher tax brackets.

What are some strategies for minimizing RMD tax burden?

Some strategies for minimizing RMD tax burden include:

– Converting traditional IRAs to Roth IRAs

– Making qualified charitable distributions (QCDs)

– Using a systematic withdrawal plan

– Utilizing tax-efficient investment strategies

– Planning for RMDs in advance

How does converting traditional IRAs to Roth IRAs help minimize RMD tax burden?

Converting traditional IRAs to Roth IRAs can help minimize RMD tax burden because Roth IRA distributions are not subject to RMD requirements, and qualified distributions from Roth IRAs are tax-free. By converting traditional IRAs to Roth IRAs, retirees can potentially reduce the amount of taxable income in their later years.

What are qualified charitable distributions (QCDs) and how do they help minimize RMD tax burden?

Qualified charitable distributions (QCDs) allow individuals who are 70½ or older to directly transfer up to $100,000 per year from an IRA to a qualified charity. This distribution counts towards the RMD requirement and is not included in the individual’s taxable income, effectively reducing the tax burden on RMDs.

What is a systematic withdrawal plan and how does it help minimize RMD tax burden?

A systematic withdrawal plan involves taking regular, systematic withdrawals from a retirement account to meet RMD requirements. By carefully planning and managing these withdrawals, retirees can potentially minimize the tax burden on RMDs by spreading out the distributions over time and managing their tax liability.

How can tax-efficient investment strategies help minimize RMD tax burden?

Tax-efficient investment strategies involve investing in assets and accounts that are tax-efficient, such as municipal bonds or tax-managed mutual funds. By strategically allocating investments across different types of accounts and assets, retirees can potentially reduce the tax impact of RMDs and minimize their overall tax burden.

Why is it important to plan for RMDs in advance?

Planning for RMDs in advance is important because it allows retirees to consider various strategies for minimizing the tax burden, such as converting traditional IRAs to Roth IRAs, making QCDs, and implementing tax-efficient investment strategies. By planning ahead, retirees can potentially optimize their RMD distributions and reduce their tax liability.