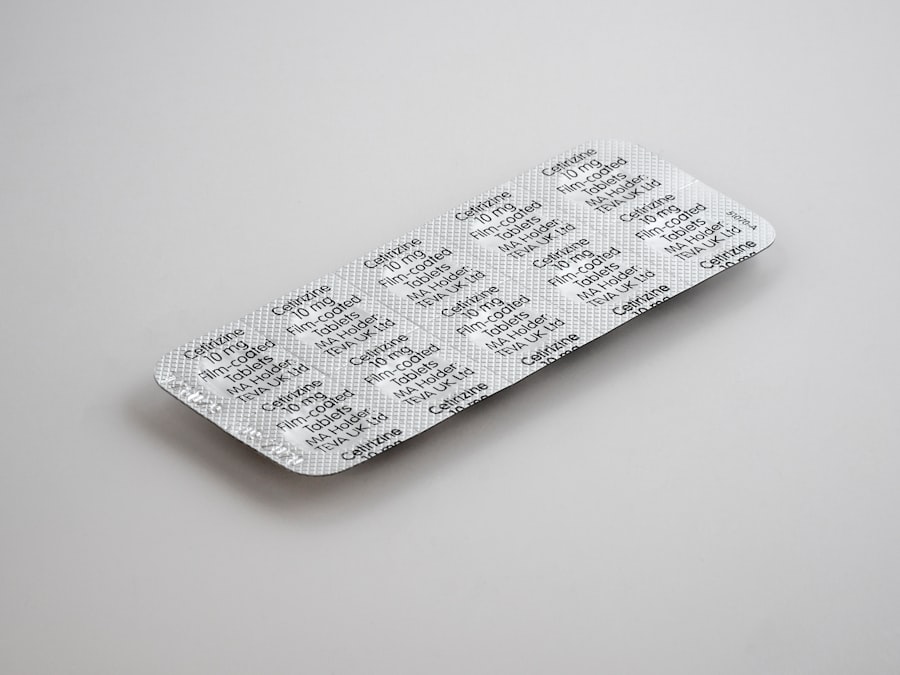

Medicare Part D is a vital component of the Medicare program, designed to provide prescription drug coverage to eligible individuals. However, if you fail to enroll in a Part D plan when you first become eligible, you may face a penalty. This penalty is a financial consequence that can significantly increase your monthly premium for Part D coverage.

The penalty is intended to encourage timely enrollment and ensure that beneficiaries have access to necessary medications without incurring additional costs due to late enrollment. The Medicare Part D penalty is calculated based on the number of months you were eligible for coverage but did not enroll in a plan. This means that if you delay your enrollment, you could end up paying more for your prescription drug coverage in the long run.

Understanding this penalty is crucial for anyone approaching Medicare eligibility, as it can impact your overall healthcare costs and access to necessary medications.

Key Takeaways

- The Medicare Part D penalty is a fee imposed on individuals who do not enroll in a Medicare Part D prescription drug plan when they are first eligible.

- Eligibility for Medicare Part D is based on age, disability status, or certain medical conditions, and individuals must be enrolled in Medicare Part A or Part B to qualify.

- The Medicare Part D penalty is calculated based on the number of months a person was eligible for Medicare Part D but did not enroll in a prescription drug plan.

- Understanding the late enrollment penalty is important because it can significantly increase the cost of Medicare Part D coverage over time.

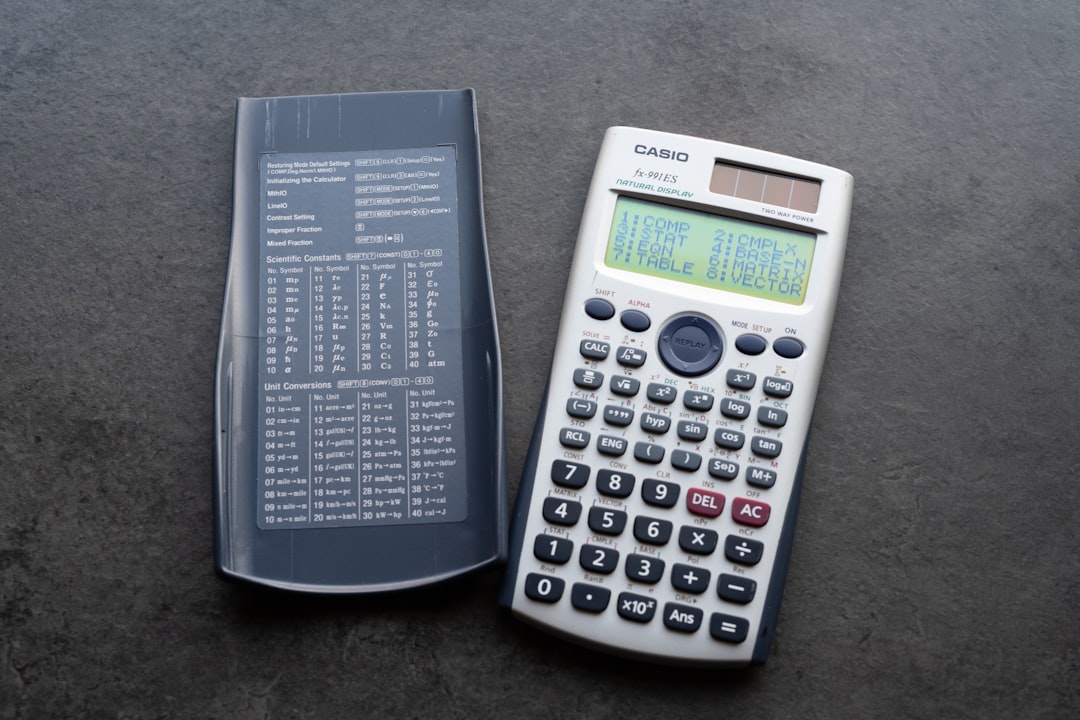

- Using a Medicare Part D penalty calculator can help individuals estimate their potential penalty and make informed decisions about enrolling in a prescription drug plan.

Who is Eligible for Medicare Part D?

Eligibility for Medicare Part D primarily hinges on your enrollment in Medicare Part A or Part If you are 65 years or older or have a qualifying disability, you are likely eligible for Medicare. Once you are enrolled in either Part A or Part B, you can sign up for a Part D plan during your Initial Enrollment Period, which lasts for seven months—three months before your 65th birthday, the month of your birthday, and three months after. Additionally, individuals under 65 who qualify due to a disability are also eligible for Medicare Part D after 24 months of receiving Social Security Disability Insurance (SSDI).

It’s important to note that even if you are not taking any medications at the time of enrollment, it is still advisable to consider enrolling in a Part D plan to avoid potential penalties later on. The eligibility criteria are straightforward, but understanding the nuances can help you make informed decisions about your healthcare coverage.

How is the Medicare Part D Penalty Calculated?

The calculation of the Medicare Part D penalty can seem complex at first glance, but it follows a specific formula that is relatively easy to understand. The penalty is determined by multiplying the number of full months you were eligible for Part D but did not enroll by 1% of the national base beneficiary premium. This national base premium can change annually, so it’s essential to stay updated on current figures.

For example, if you were eligible for 20 months without enrolling in a Part D plan, and the national base premium is $33.06 (as an example), your penalty would be calculated as follows: 20 months x 1% of $33.06 = $6.61. This amount would then be added to your monthly premium when you finally enroll in a Part D plan. It’s crucial to remember that this penalty is not a one-time fee; it will be added to your premium for as long as you remain enrolled in a Part D plan.

Understanding the Late Enrollment Penalty

| Age at Enrollment | Months Without Coverage | Penalty Percentage |

|---|---|---|

| 65 or older | 12 or more | 1% |

| 64 | 11 | 10% |

| 63 | 10 | 20% |

| 62 | 9 | 30% |

The late enrollment penalty serves as a deterrent against delaying enrollment in Medicare Part D. It is designed to encourage individuals to sign up for prescription drug coverage when they first become eligible. The rationale behind this penalty is straightforward: when you delay enrollment, you may not only miss out on necessary medications but also contribute to higher costs for the Medicare program overall.

Understanding the implications of the late enrollment penalty can help you make better decisions regarding your healthcare coverage. If you find yourself facing this penalty, it’s essential to recognize that it can significantly impact your budget over time. The longer you wait to enroll after becoming eligible, the more substantial the penalty will be, making it crucial to act promptly when it comes to securing your prescription drug coverage.

Why Should You Use the Medicare Part D Penalty Calculator?

Using a Medicare Part D penalty calculator can be an invaluable tool for anyone navigating their options for prescription drug coverage. This calculator allows you to estimate what your late enrollment penalty might be based on your specific circumstances, including how long you delayed enrollment and the current national base beneficiary premium. By inputting your information into the calculator, you can gain insights into how much extra you might pay each month if you choose to enroll late.

Moreover, understanding your potential penalty can help you make informed decisions about whether to enroll in a Part D plan now or later. It can also assist in budgeting for future healthcare costs, ensuring that you are prepared for any additional expenses that may arise from late enrollment. Ultimately, using a penalty calculator empowers you with knowledge and clarity regarding your Medicare options.

How to Use the Medicare Part D Penalty Calculator

Using the Medicare Part D penalty calculator is a straightforward process that can yield significant insights into your potential costs. To begin, gather relevant information such as the number of months you were eligible for Part D but did not enroll and the current national base beneficiary premium. Once you have this data, navigate to a reliable online calculator specifically designed for this purpose.

Input the number of months into the designated field and ensure that you have the correct national base premium figure for the current year. After entering this information, the calculator will provide an estimate of your late enrollment penalty. This estimate will help you understand how much more you may need to pay each month if you decide to enroll in a Part D plan after missing your initial enrollment period.

Avoiding the Medicare Part D Penalty

Avoiding the Medicare Part D penalty requires proactive planning and timely action on your part. The most effective way to sidestep this financial consequence is by enrolling in a Part D plan during your Initial Enrollment Period.

If you miss this window, consider enrolling during the Annual Enrollment Period (AEP), which occurs each year from October 15 to December 7. During this time, you can sign up for a new plan or switch existing plans without incurring penalties. Additionally, if you have credible prescription drug coverage through an employer or another source, ensure that it meets Medicare’s standards so that you can avoid penalties when transitioning to Medicare.

Reassessing Your Medicare Part D Coverage

As life circumstances change, so too might your healthcare needs and preferences regarding Medicare Part D coverage. It’s essential to reassess your plan regularly—at least once a year—to ensure that it continues to meet your needs effectively. During the Annual Enrollment Period (AEP), take the time to review your current plan’s formulary, premiums, and out-of-pocket costs associated with medications.

If you find that your current plan no longer provides adequate coverage or has become too expensive, consider exploring other options available in your area. Comparing different plans can help you identify one that offers better benefits or lower costs tailored to your specific medication needs. Regular reassessment not only helps avoid unnecessary expenses but also ensures that you have access to the medications required for maintaining your health.

Understanding the Costs of Medicare Part D

Understanding the costs associated with Medicare Part D is crucial for effective budgeting and planning for healthcare expenses. When enrolling in a Part D plan, you’ll encounter several types of costs: premiums, deductibles, copayments, and coinsurance. The premium is the monthly fee paid for coverage, while deductibles represent the amount you must pay out-of-pocket before your plan begins covering costs.

Copayments and coinsurance are additional costs incurred when filling prescriptions; copayments are fixed amounts paid per prescription, while coinsurance involves paying a percentage of the total cost of medication. Familiarizing yourself with these various costs will help you make informed decisions about which plan best suits your financial situation and medication needs.

Comparing Medicare Part D Plans

When it comes to selecting a Medicare Part D plan, comparing different options is essential for finding one that aligns with your healthcare needs and budgetary constraints. Each plan varies in terms of premiums, deductibles, covered medications (formulary), and pharmacy networks. To make an informed choice, start by listing your current medications and their dosages.

Once you have this information, use online tools or resources provided by Medicare.gov to compare plans based on their formularies and costs associated with your specific medications. Pay attention not only to premiums but also to out-of-pocket expenses like deductibles and copayments. By thoroughly comparing plans, you’ll be better equipped to choose one that offers comprehensive coverage at an affordable price.

Getting Help with Medicare Part D Penalty Issues

Navigating the complexities of Medicare Part D and understanding potential penalties can be overwhelming at times. Fortunately, there are numerous resources available to assist you in addressing any questions or concerns related to penalties or coverage options. The official Medicare website offers comprehensive information about enrollment periods, penalties, and available plans.

Additionally, consider reaching out to local State Health Insurance Assistance Programs (SHIPs) or contacting licensed insurance agents who specialize in Medicare products. These professionals can provide personalized guidance tailored to your unique situation and help clarify any confusion regarding penalties or coverage options. Seeking assistance ensures that you’re making informed decisions about your healthcare while minimizing potential financial repercussions associated with late enrollment penalties.

If you’re trying to understand the intricacies of the Medicare Part D penalty and how it might affect your healthcare costs, you might find it helpful to use a Medicare Part D penalty calculator. This tool can provide insights into potential penalties for late enrollment in a Medicare prescription drug plan.