Annuity income is a financial product designed to provide you with a steady stream of payments over a specified period, often used as a means of securing financial stability during retirement. When you invest in an annuity, you essentially enter into a contract with an insurance company, which promises to pay you a certain amount of money at regular intervals. This can be particularly appealing as it offers predictability in your financial planning, allowing you to budget your expenses more effectively.

The payments can begin immediately or at a future date, depending on the type of annuity you choose. The appeal of annuity income lies in its ability to provide a reliable source of funds, especially when other income sources may dwindle. For many, this means having peace of mind knowing that they will receive a consistent income regardless of market fluctuations.

Annuities can be tailored to meet your specific needs, whether you are looking for short-term income or long-term financial security. Understanding the nuances of how annuities work is crucial for making informed decisions about your financial future.

Key Takeaways

- Annuity income provides a steady stream of payments over a specified period, often used as a retirement income strategy.

- Tax benefits of annuity income include tax-deferred growth, potential tax deductions, and the ability to spread out tax liability over time.

- Types of annuity income include immediate and deferred annuities, each with their own tax implications and payout structures.

- Tax-deferred annuities allow for growth of funds without immediate tax implications, while taxable annuities are subject to annual taxation on earnings.

- Maximizing tax benefits with annuity income involves strategic planning, understanding tax implications, and utilizing available tax deductions and credits.

Importance of Tax Benefits

One of the most significant advantages of annuity income is the tax benefits associated with it. When you invest in an annuity, the money you contribute grows tax-deferred until you begin to withdraw it. This means that you won’t owe taxes on the earnings until you start receiving payments, allowing your investment to grow more rapidly than it would in a taxable account.

This feature can be particularly beneficial for long-term financial planning, as it enables you to accumulate wealth without the immediate burden of taxes. Moreover, the tax treatment of annuities can vary based on how you withdraw funds. For instance, if you take distributions from your annuity during retirement, only the earnings portion of your withdrawals is subject to taxation.

This can result in a lower overall tax burden compared to other investment vehicles. Understanding these tax implications is essential for maximizing your financial strategy and ensuring that you are making the most of your annuity investments.

Types of Annuity Income

There are several types of annuities available, each designed to cater to different financial goals and risk tolerances. Fixed annuities provide guaranteed payments and are often seen as a safe investment option. With fixed annuities, you know exactly how much income you will receive, making them an attractive choice for those who prioritize stability and predictability in their financial planning.

On the other hand, variable annuities allow you to invest in various sub-accounts that can fluctuate based on market performance. While this option carries more risk, it also offers the potential for higher returns. Indexed annuities combine features of both fixed and variable annuities, providing a guaranteed minimum return while also allowing for some growth linked to a stock market index.

Understanding these different types of annuities will help you choose the one that aligns best with your financial objectives and risk tolerance.

Tax-Deferred Annuities

| Metrics | Data |

|---|---|

| Contribution Limit | Varies by year |

| Tax Benefits | Contributions are tax-deferred |

| Withdrawal Age | 59 ½ or older |

| Penalty for Early Withdrawal | 10% before age 59 ½ |

| Investment Options | Stocks, bonds, mutual funds, etc. |

Tax-deferred annuities are particularly appealing for individuals looking to grow their investments without immediate tax implications. When you contribute to a tax-deferred annuity, your investment grows without being taxed until you withdraw funds. This allows for compounding growth over time, which can significantly enhance your retirement savings.

The longer you keep your money invested in a tax-deferred annuity, the more potential it has to grow. Additionally, tax-deferred annuities can be an effective tool for estate planning. If you pass away before fully utilizing your annuity, the remaining balance can be transferred to your beneficiaries without incurring immediate tax liabilities.

This feature makes tax-deferred annuities not only a means of generating income but also a strategic component of your overall financial legacy.

Taxable Annuities

While tax-deferred annuities offer significant advantages, it’s essential to understand that not all annuities are created equal when it comes to taxation. Taxable annuities do not provide the same benefits as their tax-deferred counterparts. When you invest in a taxable annuity, any earnings generated are subject to taxation in the year they are earned.

This means that if you withdraw funds from a taxable annuity, you will owe taxes on the earnings portion immediately. This immediate tax liability can impact your overall investment strategy and cash flow during retirement. It’s crucial to weigh the pros and cons of taxable versus tax-deferred options based on your financial situation and goals.

By understanding how taxable annuities work, you can make informed decisions that align with your long-term financial objectives.

Maximizing Tax Benefits with Annuity Income

To maximize the tax benefits associated with annuity income, it’s essential to have a clear understanding of your financial situation and retirement goals. One effective strategy is to consider the timing of your withdrawals carefully. By delaying withdrawals until after retirement, when your taxable income may be lower, you can potentially reduce your overall tax burden.

Additionally, utilizing tax-efficient withdrawal strategies can further enhance your benefits. For instance, withdrawing from taxable accounts first before tapping into your tax-deferred annuities can help minimize taxes owed on your retirement income. Consulting with a financial advisor who specializes in tax planning can provide valuable insights tailored to your unique circumstances.

Annuity Income and Retirement Planning

Incorporating annuity income into your retirement planning can provide a sense of security and stability during your golden years. As you approach retirement age, having a reliable source of income becomes increasingly important. Annuities can serve as a safety net, ensuring that you have consistent cash flow to cover essential expenses such as housing, healthcare, and daily living costs.

Moreover, annuities can complement other retirement savings vehicles like 401(k)s and IRAs. By diversifying your income sources, you can create a more robust financial plan that mitigates risks associated with market volatility. Understanding how annuity income fits into your overall retirement strategy is crucial for achieving long-term financial success.

Tax Strategies for Annuity Income

Implementing effective tax strategies for managing your annuity income can significantly impact your overall financial health. One approach is to consider the use of qualified versus non-qualified annuities. Qualified annuities are funded with pre-tax dollars from retirement accounts like IRAs or 401(k)s, while non-qualified annuities are funded with after-tax dollars.

Understanding the differences between these two types can help you make informed decisions about which option aligns best with your tax strategy. Another strategy involves leveraging tax brackets effectively. By strategically timing withdrawals from your annuity during years when your taxable income is lower, you can minimize the taxes owed on those distributions.

Additionally, consider using deductions and credits available during retirement to offset any taxable income generated from your annuity payouts.

Tax Considerations for Annuity Payouts

When it comes time to receive payouts from your annuity, understanding the tax implications is essential for effective financial planning. As mentioned earlier, only the earnings portion of your withdrawals is subject to taxation in most cases. This means that if you’ve contributed after-tax dollars into your annuity, those contributions will not be taxed again upon withdrawal.

This distinction will help you accurately calculate your tax liability when taking distributions. Additionally, if you’re considering surrendering an annuity or taking lump-sum payments, be aware that these actions may trigger different tax consequences than regular periodic withdrawals.

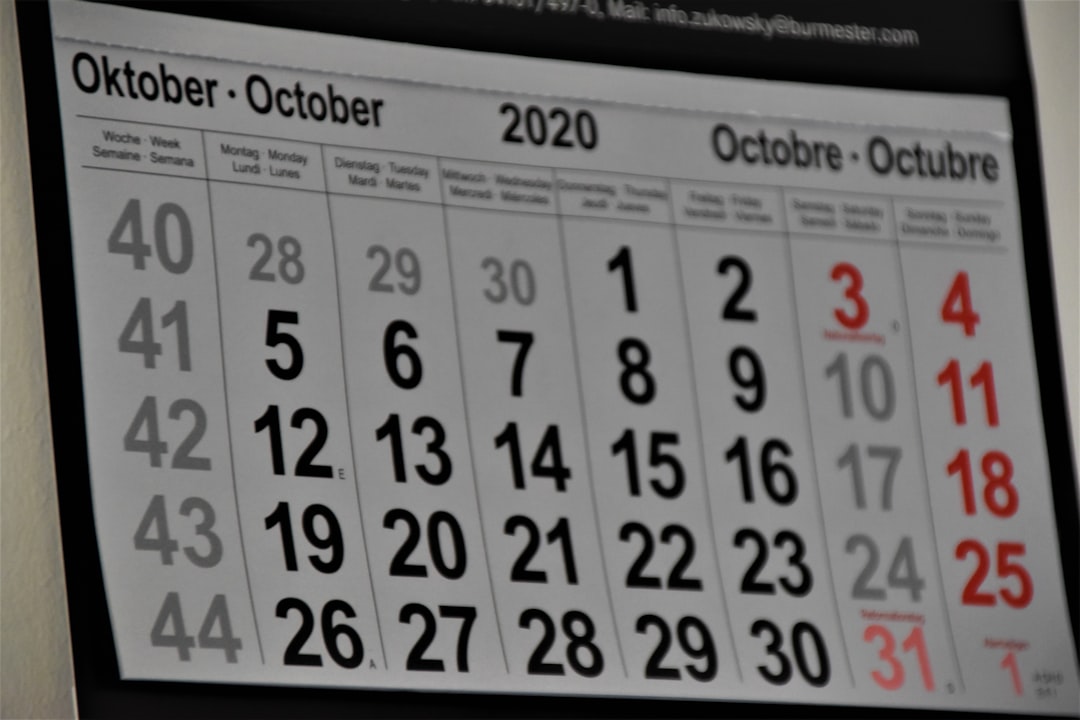

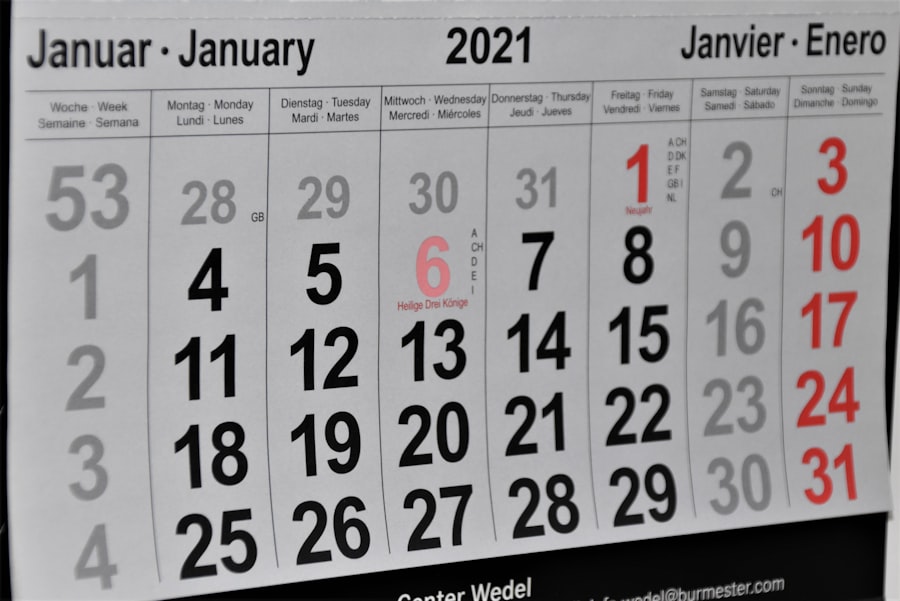

Utilizing Annuity Income Calendar for Tax Planning

Annuity income calendars can be invaluable tools for managing your finances and optimizing tax strategies throughout the year. By keeping track of when payments are scheduled to arrive and understanding their potential tax implications, you can plan ahead and make informed decisions about withdrawals and investments. For instance, if you know that certain months will yield higher payouts from your annuity, you can strategize other financial moves accordingly—such as timing other income sources or expenses around those dates to minimize taxes owed or maximize deductions available during those periods.

Tips for Effective Tax Planning with Annuity Income

To ensure effective tax planning with your annuity income, consider these practical tips: First, maintain clear records of all contributions and withdrawals related to your annuity investments. This documentation will be crucial when calculating taxes owed and understanding how much of your income is taxable versus non-taxable. Second, consult with a qualified financial advisor or tax professional who understands the intricacies of annuities and their tax implications.

They can provide personalized guidance tailored to your unique situation and help you navigate complex regulations effectively. Lastly, stay informed about changes in tax laws that may affect how annuities are taxed in the future. By remaining proactive and adaptable in your approach to managing annuity income and its associated taxes, you’ll be better equipped to achieve long-term financial success while minimizing liabilities along the way.

For effective tax planning, understanding the timing of annuity income is crucial. A related article that provides valuable insights on this topic can be found at this link. It discusses how to align your annuity income calendar with your overall tax strategy, ensuring that you maximize your benefits while minimizing your tax liabilities.

WATCH THIS 🛑 The Medicare Part D Lie That Steals Your $10,000 Drug Savings

FAQs

What is an annuity income calendar?

An annuity income calendar is a schedule that outlines the dates and amounts of income payments from an annuity contract. It helps individuals plan for and manage their income from annuities, which can have tax implications.

Why is an annuity income calendar important for tax planning?

An annuity income calendar is important for tax planning because it helps individuals anticipate and manage the tax implications of their annuity income. By knowing when income payments will be received, individuals can plan for potential tax liabilities and make informed decisions about their tax strategies.

What information should be included in an annuity income calendar?

An annuity income calendar should include the dates and amounts of each income payment from the annuity contract. It may also include information about the tax treatment of the income payments, such as whether they are subject to ordinary income tax or potentially eligible for more favorable tax treatment.

How can an annuity income calendar help with tax planning?

An annuity income calendar can help with tax planning by allowing individuals to anticipate their income from annuities and plan for potential tax liabilities. By knowing when income payments will be received, individuals can make informed decisions about tax withholding, estimated tax payments, and other tax planning strategies.

Are there any special considerations for creating an annuity income calendar for tax planning?

When creating an annuity income calendar for tax planning, individuals should consider any special tax rules or provisions that may apply to annuity income. For example, certain types of annuities may have different tax treatment, and individuals should be aware of any potential tax consequences related to their specific annuity contracts.