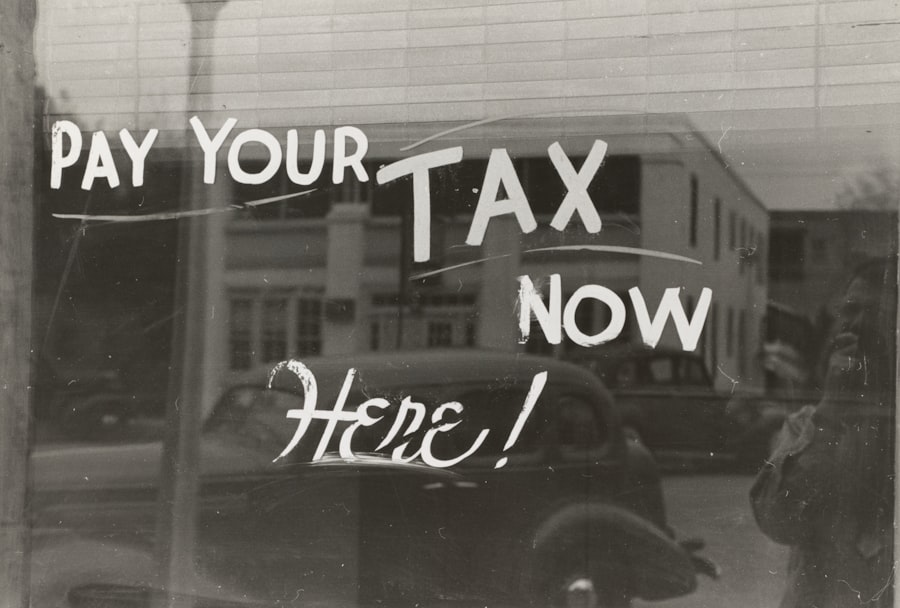

When you invest in an annuity, it’s crucial to grasp the nuances of how taxation works in this realm. Annuities are often marketed as tax-deferred investment vehicles, which means that you won’t owe taxes on the earnings until you withdraw funds. This can be an attractive feature, especially for those looking to grow their retirement savings without the immediate tax burden.

However, it’s essential to understand that once you start taking distributions, the tax implications can become complex. The Internal Revenue Service (IRS) treats annuity withdrawals differently based on whether they are considered a return of principal or earnings. As you navigate the world of annuities, you should be aware that the taxation of your withdrawals will depend on several factors, including the type of annuity you have and how long you’ve held it.

For instance, if you have a qualified annuity, which is funded with pre-tax dollars, your entire withdrawal will be subject to income tax. Conversely, with a non-qualified annuity, only the earnings portion is taxable. Understanding these distinctions is vital for effective financial planning and ensuring that you’re not caught off guard when it comes time to access your funds.

Key Takeaways

- Annuity taxation can be complex and it’s important to understand the tax implications before investing.

- Annuity tax traps can occur when investors are not aware of the tax consequences of their annuity investments.

- In a case study, 0K was stolen from an investor due to annuity tax traps and lack of awareness.

- Recognizing warning signs of annuity tax traps can help investors protect themselves from potential fraud.

- Seeking legal assistance and reporting annuity tax fraud are important steps to take if you suspect fraudulent activity.

How Annuity Tax Traps Work

Annuity tax traps can ensnare even the most vigilant investors, often leading to unexpected tax liabilities. These traps typically arise from misunderstandings about how withdrawals are taxed or from making decisions without fully considering the long-term implications. For example, if you withdraw funds from your annuity before reaching the age of 59½, you may face not only income tax on the earnings but also a 10% early withdrawal penalty.

This can significantly diminish your returns and derail your financial plans. Moreover, some investors may fall victim to misleading sales tactics that promise high returns without adequately explaining the tax consequences. You might be enticed by the idea of immediate liquidity or high-interest rates, only to find that the tax implications are far more complicated than initially presented.

It’s essential to approach annuity investments with a critical eye and a thorough understanding of how these tax traps can impact your overall financial health.

Case Study: $200K Stolen

Consider a hypothetical case where an investor named John purchased an annuity with a significant sum of $200,000.

However, John was unaware of the potential pitfalls associated with his investment.

After a few years, he decided to withdraw a portion of his funds to cover unexpected medical expenses. To his shock, he discovered that he owed a substantial amount in taxes and penalties due to early withdrawal. This case illustrates how easily one can fall into an annuity tax trap.

John’s lack of understanding regarding the tax implications of his withdrawal led to a financial loss that he hadn’t anticipated. Furthermore, he later learned that he had been misled by his financial advisor about the terms of his annuity contract. This unfortunate scenario serves as a cautionary tale for anyone considering investing in an annuity without fully understanding the associated risks and tax consequences.

Recognizing Warning Signs

| Warning Sign | Description |

|---|---|

| Change in Behavior | Noticeable changes in mood, behavior, or personality |

| Isolation | Withdrawing from social activities and relationships |

| Substance Abuse | Increased use of alcohol or drugs |

| Self-Harm | Engaging in self-destructive behaviors |

| Extreme Mood Swings | Unpredictable and intense shifts in emotions |

As you delve deeper into the world of annuities, it’s essential to recognize warning signs that may indicate potential issues with your investment or advisor. One red flag is if your advisor pressures you into making quick decisions without allowing you time to review the details thoroughly. High-pressure sales tactics often signal that something may be amiss, and it’s crucial to take a step back and evaluate the situation critically.

Another warning sign is a lack of transparency regarding fees and charges associated with your annuity. If your advisor is vague about how much you’ll pay in fees or how those fees will impact your returns, it’s time to ask more questions. A reputable advisor should be willing to provide clear information about all costs involved in your investment.

Being vigilant about these warning signs can help you avoid falling victim to an annuity tax trap or other fraudulent schemes.

Protecting Yourself from Annuity Tax Traps

To safeguard yourself from potential annuity tax traps, it’s essential to educate yourself about the various types of annuities available and their respective tax implications. Take the time to research and understand how each type works, including fixed, variable, and indexed annuities. By arming yourself with knowledge, you’ll be better equipped to make informed decisions that align with your financial goals.

Additionally, consider working with a certified financial planner who specializes in retirement planning and has experience with annuities. A knowledgeable advisor can help you navigate the complexities of annuity taxation and ensure that you’re making choices that will benefit you in the long run. By taking proactive steps to protect yourself, you can minimize your risk of falling into an annuity tax trap.

Seeking Legal Assistance

If you find yourself entangled in an annuity tax trap or suspect fraudulent activity related to your investment, seeking legal assistance may be necessary. An attorney who specializes in financial fraud or securities law can provide valuable guidance on how to proceed. They can help you understand your rights and options for recovering lost funds or addressing any legal issues that may arise from your situation.

Legal professionals can also assist in negotiating with financial institutions or advisors on your behalf. If you believe that you’ve been misled or defrauded, having an experienced attorney by your side can strengthen your case and increase your chances of achieving a favorable outcome. Don’t hesitate to reach out for legal support if you feel overwhelmed or uncertain about how to navigate your circumstances.

Reporting Annuity Tax Fraud

If you suspect that you’ve fallen victim to annuity tax fraud, it’s crucial to report it promptly. The first step is to gather all relevant documentation related to your investment, including contracts, statements, and any correspondence with your advisor or financial institution. This information will be essential when filing a report with regulatory agencies or law enforcement.

You can report suspected fraud to several organizations, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These agencies are responsible for overseeing financial markets and protecting investors from fraudulent activities. By reporting fraud, you not only take steps to protect yourself but also help prevent others from becoming victims of similar schemes.

Steps to Take if You Suspect Annuity Tax Fraud

If you suspect that you’ve been a victim of annuity tax fraud, there are several steps you should take immediately. First and foremost, document everything related to your investment—this includes keeping records of all communications with your advisor and any transactions made within your account. Having a comprehensive record will be invaluable if you need to pursue legal action or file a complaint.

Next, consider contacting your financial institution directly to discuss your concerns. They may have procedures in place for addressing fraud allegations and can guide you through the process of resolving any issues related to your account. Additionally, consult with a financial advisor or attorney who specializes in fraud cases for further guidance on how best to protect yourself and recover any lost funds.

The Role of Regulatory Agencies

Regulatory agencies play a vital role in overseeing financial markets and protecting investors from fraudulent activities related to annuities and other investment products. Organizations such as the SEC and FINRA are tasked with enforcing securities laws and ensuring that financial advisors adhere to ethical standards when dealing with clients. They investigate complaints of fraud and misconduct and have the authority to impose penalties on those found guilty of violating regulations.

These agencies also provide valuable resources for investors seeking information about their rights and protections under the law. By understanding the role of regulatory agencies, you can better navigate any issues related to annuity investments and know where to turn for assistance if needed.

Annuity Tax Trap Prevention Tips

To prevent falling into an annuity tax trap, consider implementing several proactive strategies. First, always conduct thorough research before investing in any financial product. Understand the terms and conditions associated with your annuity contract, including withdrawal penalties and tax implications.

Knowledge is power when it comes to making informed decisions about your investments. Additionally, seek out reputable financial advisors who prioritize transparency and ethical practices. Look for professionals who are registered with regulatory agencies and have a solid track record in helping clients navigate retirement planning and annuities.

By surrounding yourself with trustworthy experts, you can significantly reduce your risk of encountering tax traps or fraudulent schemes.

Recovering Stolen Funds

If you find yourself in a situation where funds have been stolen due to fraud related to an annuity investment, recovery may be possible through various avenues. First, consult with legal professionals who specialize in financial fraud cases; they can guide you through the process of filing claims against responsible parties or pursuing litigation if necessary. Additionally, consider reaching out to regulatory agencies that oversee financial markets; they may have resources available for victims of fraud seeking restitution for their losses.

While recovering stolen funds can be challenging, taking swift action and seeking professional assistance can increase your chances of achieving a favorable outcome. In conclusion, navigating the complexities of annuity taxation requires vigilance and education. By understanding how taxation works within this investment vehicle and recognizing potential traps, you can protect yourself from costly mistakes.

Always stay informed about warning signs of fraud and seek legal assistance when necessary; doing so will empower you as an investor and help secure your financial future.

The annuity tax trap can significantly impact retirees, potentially costing them substantial amounts of money, sometimes as much as two hundred thousand dollars.

Check it out here: Explore Senior Health.

WATCH THIS 🛑 The Medicare Part D Lie That Steals Your $10,000 Drug Savings

FAQs

What is an annuity tax trap?

An annuity tax trap refers to a situation where an individual with an annuity investment faces unexpected tax consequences that significantly reduce the value of their investment.

How does an annuity tax trap occur?

An annuity tax trap can occur when the annuity owner makes withdrawals or surrenders the annuity before reaching the age of 59 ½, triggering early withdrawal penalties and additional taxes.

What are the potential consequences of an annuity tax trap?

The potential consequences of an annuity tax trap include incurring early withdrawal penalties, paying additional taxes on the withdrawn amount, and potentially losing a significant portion of the investment’s value.

How can individuals avoid falling into an annuity tax trap?

To avoid falling into an annuity tax trap, individuals should carefully review the terms of their annuity contract, understand the tax implications of withdrawals and surrenders, and consider consulting with a financial advisor or tax professional.

What are some strategies for mitigating the impact of an annuity tax trap?

Some strategies for mitigating the impact of an annuity tax trap include waiting until the age of 59 ½ to make withdrawals, considering a 1035 exchange to transfer the annuity to a more tax-advantaged investment, and exploring options for annuitizing the contract to receive regular payments without triggering penalties.