You’ve reached a significant life stage, one where your hard-earned retirement savings transition from accumulation to distribution. This era arrives with its own set of rules, the most prominent being Required Minimum Distributions (RMDs). Navigating these rules successfully is paramount, as failing to do so can trigger a substantial 25% penalty on the amount you were obligated to withdraw but didn’t. This article will equip you with strategies to understand and, crucially, to sidestep this penalty, ensuring your retirement journey remains on track.

Before you can effectively avoid a penalty, you must first comprehend what an RMD is, when it applies, and the entities it encompasses. Think of RMDs as the IRS’s way of ensuring that pre-tax retirement accounts are eventually taxed. These aren’t voluntary withdrawals; they are mandatory.

What Constitutes an RMD?

An RMD is the minimum amount of money you must withdraw from certain retirement accounts each year once you reach a specific age. This amount is calculated based on your account balance at the end of the previous year and your life expectancy as determined by IRS uniform lifetime tables. It’s a proportional distribution, designed to deplete your account over your statistical lifespan.

When Do RMDs Begin?

Historically, RMDs began at age 70½. However, legislative changes, specifically the SECURE Act and SECURE 2.0 Act, have shifted this threshold. For individuals born in 1950 or earlier, the age remains 70½. If you were born between 1951 and 1959, your RMDs begin at age 73. And for those born in 1960 or later, the RMD starting age is 75. It is crucial to identify which cohort you belong to, as this directly affects your RMD initiation point, much like a clock tower striking a new hour, signaling the start of a new obligation.

Which Accounts Are Subject to RMDs?

The umbrella of RMDs covers a wide array of retirement savings vehicles. These generally include:

- Traditional IRAs: The most common form of RMD-subject account.

- SEP IRAs and SIMPLE IRAs: Employer-sponsored plans that function similarly to Traditional IRAs in terms of RMD rules.

- 401(k)s, 403(b)s, and 457(b)s: These employer-sponsored defined contribution plans are also subject to RMDs. A notable exception exists if you are still employed by the company sponsoring the 401(k) and are not a 5% owner of the company; in this scenario, you may be able to delay RMDs from that specific 401(k) until you retire.

- Profit-Sharing Plans and Money Purchase Plans: Other forms of employer-sponsored retirement plans.

Crucially, Roth IRAs are exempt from RMDs for the original owner. This is a significant distinction, as Roth contributions are made with after-tax dollars, meaning the IRS has already collected its share. However, inherited Roth IRAs are subject to RMDs for the beneficiary.

To effectively avoid the 25 percent excise tax penalty on required minimum distributions (RMDs), it’s crucial to stay informed about the rules and strategies surrounding RMDs. A related article that provides valuable insights on this topic can be found at Explore Senior Health. This resource outlines key considerations and tips to ensure compliance with RMD regulations, helping retirees manage their withdrawals efficiently and avoid unnecessary penalties.

Proactive Strategies to Manage or Mitigate RMDs

Managing RMDs effectively requires foresight and a strategic approach. Waiting until the last minute is akin to trying to navigate a dense fog – it makes the journey far more perilous. Here are several proactive strategies you can employ.

Converting to a Roth IRA

One of the most potent strategies to reduce future RMDs is to convert pre-tax retirement funds to a Roth IRA. This is often referred to as a “Roth conversion.”

Understanding the Mechanics of Roth Conversions

When you convert funds from a Traditional IRA, 401(k), or similar pre-tax account to a Roth IRA, you pay income tax on the converted amount in the year of the conversion. This might seem counterintuitive since you’re trying to avoid taxes, but it’s a strategic trade-off. You’re essentially pre-paying your tax liability now to eliminate it entirely in the future. Once the funds are in the Roth IRA, they grow tax-free and are withdrawn tax-free in retirement, completely circumventing RMDs for the original account owner.

Strategic Timing for Conversions

The optimal time for Roth conversions is typically during years when you anticipate being in a lower tax bracket. This could be in the years between retirement and when your RMDs are slated to begin, or during periods of lower income due due to job changes or temporary unemployment. It’s a delicate balancing act – converting too much in a single year could push you into a higher tax bracket, diminishing the strategy’s effectiveness. Consider a multi-year conversion strategy, systematically shifting portions of your pre-tax assets to a Roth IRA over several years, much like a controlled burn, containing the tax impact in manageable increments.

Qualified Charitable Distributions (QCDs)

For individuals who are charitably inclined, Qualified Charitable Distributions (QCDs) offer a powerful way to satisfy RMDs while simultaneously supporting causes you care about.

Eligibility and Limitations of QCDs

To utilize a QCD, you must be 70½ or older. You can direct up to $105,000 (indexed for inflation) of your IRA assets directly to a qualified charity each year. These distributions count towards your RMD for that year and are excluded from your taxable income. This is a significant advantage, as unlike a standard charitable deduction, a QCD reduces your Adjusted Gross Income (AGI), which can have a cascading positive effect on other tax calculations, such as Medicare premiums.

Strategic Use of QCDs

QCDs are particularly beneficial if you take the standard deduction and therefore wouldn’t receive a tax benefit from a traditional charitable donation. By using a QCD, you fulfill your RMD obligation without increasing your taxable income, effectively getting a tax-free distribution that also supports your philanthropic goals. It’s a win-win scenario, like finding a shortcut that’s also more scenic.

Tactical Maneuvers to Ensure Compliance

Beyond proactive planning, there are specific tactical maneuvers you can employ in the immediate future to guarantee you meet your RMD obligations and avoid the penalty. These are your final checks and balances, the last line of defense against the 25% tax.

Calculate Your RMD Accurately

The foundation of compliance is an accurate calculation of your RMD. This is not a task to be rushed or guessed at.

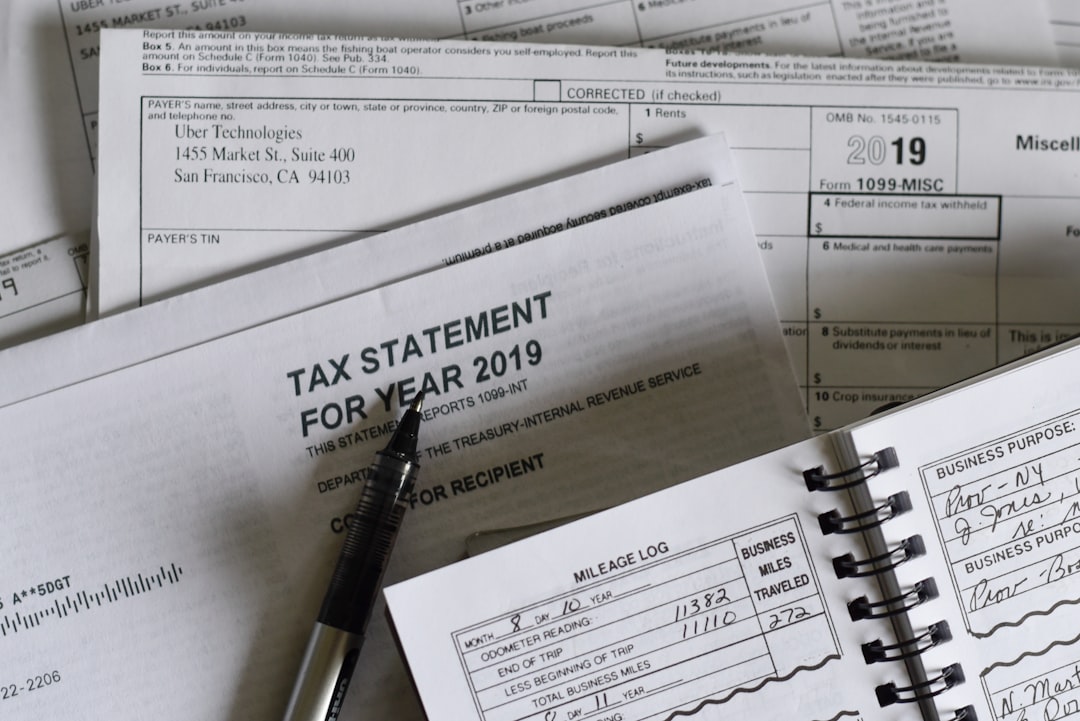

Obtaining Your Account Balances

Your RMD for the current year is based on the fair market value of your retirement accounts as of December 31st of the previous year. You will need this figure for each RMD-subject account you hold. Most custodians and plan administrators will provide this information, often on your year-end statements.

Using the Correct Life Expectancy Table

The IRS provides three life expectancy tables: the Uniform Lifetime Table (the most common), the Joint Life and Last Survivor Expectancy Table (for beneficiaries much younger than the account owner), and the Single Life Expectancy Table (for beneficiaries of inherited IRAs). For the vast majority of individuals, the Uniform Lifetime Table will be the correct one to use. This table provides a divisor based on your age. Divide your year-end account balance by this divisor to determine your RMD. Many financial institutions will calculate and notify you of your RMD, but it’s prudent to double-check their figures, much like auditing your own tax return.

Timely Withdrawals

Once you know your RMD, the next critical step is to withdraw it by the deadline.

The “First RMD” Rule

For your very first RMD, you have a unique window. You can take your first RMD in the year you turn the RMD age, or you can delay it until April 1st of the following year. However, if you choose to delay, you’ll have to take two RMDs in that “second” year – your first (delayed) RMD by April 1st, and your second RMD (for the current year) by December 31st. This can lead to a significant increase in taxable income in that year, potentially pushing you into a higher tax bracket. Generally, it is advisable to take your first RMD in your RMD “start year” to avoid this “double RMD” scenario.

Subsequent RMD Deadlines

For all subsequent RMDs after your first, the deadline is always December 31st of the current calendar year. There are no extensions for these. Missing this deadline is a surefire way to trigger the 25% penalty. Think of it as a hard stop, a fixed point in time that cannot be moved.

Aggregating RMDs for Multiple Accounts

If you have multiple Tradition IRAs, SEP IRAs, or SIMPLE IRAs, you can calculate the RMD for each individual account and then sum them up. You are then permitted to take the total RMD amount from any one (or more) of your Traditional IRAs, SEP IRAs, or SIMPLE IRAs.

Separate Accounts, Single Withdrawal

This aggregation rule means you don’t have to withdraw a proportional amount from each account. For example, if you have three Traditional IRAs, you can calculate the RMD for each, add them up, and then withdraw the entire sum from just one of those IRAs. This provides flexibility, allowing you to choose the account that might be easiest to access or one with holdings you prefer to liquidate.

Employer Plans are Separate

It’s crucial to note that this aggregation rule does not apply to RMDs from 401(k)s, 403(b)s, or 457(b)s. RMDs from these employer-sponsored plans must be taken separately from each specific plan. You cannot aggregate your 401(k) RMD with your Traditional IRA RMD, nor can you aggregate RMDs across multiple 401(k) plans unless you consolidate them into a single plan. Each employer-sponsored plan is its own distinct entity for RMD purposes, like separate wells, each requiring its own draw.

Planning for Beneficiaries and Inherited Accounts

The RMD landscape also shifts significantly when accounts are inherited. Understanding these rules is crucial to ensure your beneficiaries don’t inadvertently incur penalties.

The 10-Year Rule

For most non-spouse beneficiaries who inherited an IRA or 401(k) after January 1, 2020, the SECURE Act introduced the “10-year rule.” This rule generally requires that the entire inherited account be distributed by the end of the tenth calendar year following the account owner’s death.

Implications for Annual Withdrawals

Initially, there was some ambiguity regarding whether annual RMDs were required within this 10-year period if the original owner had already started taking RMDs. The IRS has since clarified this: if the original account owner died on or after their RMD required beginning date, the non-spouse beneficiary must take annual RMDs in years 1-9, with the remaining balance distributed by the end of year 10. If the original account owner died before their RMD required beginning date, then no annual RMDs are required for the beneficiary in years 1-9, but the entire account must still be fully distributed by the end of year 10. This distinction is significant, acting as a fork in the road for beneficiaries.

Exceptions to the 10-Year Rule

Not all beneficiaries are subject to the strict 10-year rule. Certain “eligible designated beneficiaries” still qualify for life expectancy payments. These include:

- Spouses: A surviving spouse has several options, including treating the inherited IRA as their own, rolling it into their own IRA, or taking distributions over their life expectancy.

- Minor Children of the Account Holder: Their RMDs are based on their life expectancy until they reach the age of majority, at which point the 10-year rule applies.

- Disabled Individuals: As defined by the IRS.

- Chronically Ill Individuals: As defined by the IRS.

- Individuals Not More Than 10 Years Younger Than the Account Holder: This often applies to siblings or close friends.

Understanding your beneficiary’s status is paramount when considering inheritance. Proper planning, including naming contingent beneficiaries and understanding the potential tax implications for different beneficiary types, can prevent future headaches and penalties.

To effectively avoid the 25 percent RMD excise tax penalty, it is essential to understand the rules surrounding required minimum distributions. A helpful resource that provides valuable insights on this topic can be found in a related article on senior health and financial planning. By staying informed and planning ahead, retirees can ensure they meet their distribution requirements without incurring unnecessary penalties. For more information, you can read the article here: Explore Senior Health.

What to Do If You Miss an RMD

| Metric | Description | Typical Value | Notes |

|---|---|---|---|

| Required Minimum Distribution (RMD) | Minimum amount that must be withdrawn annually from retirement accounts | Varies by account balance and IRS life expectancy tables | Failure to withdraw triggers penalty |

| RMD Excise Tax Penalty | Penalty for failing to take the full RMD amount | 25% of the amount not withdrawn | Can be reduced to 10% if IRS waiver is granted |

| IRS Waiver Request | Request to reduce or waive the excise tax penalty | Varies | Must demonstrate reasonable error and corrective action |

| Deadline for RMD Withdrawal | Deadline to take RMD for the year | December 31 of each year | First RMD can be delayed until April 1 of the year after turning 73 (or 72 depending on birth year) |

| Age to Start RMDs | Age at which RMDs must begin | 73 (for those turning 72 after 2022) | Previously 70½ before SECURE Act 2.0 |

| Corrective Distribution | Amount withdrawn after missing RMD to avoid penalty | Full missed RMD amount | Must be taken as soon as possible |

Despite your best efforts, you might find yourself in a situation where you’ve missed an RMD. While the notion of a 25% penalty is daunting, there are steps you can take to mitigate the damage.

The Penalty for Missed RMDs

The penalty for failing to take a required minimum distribution is indeed substantial. It is 25% of the amount that should have been withdrawn but wasn’t. For instance, if your RMD was $20,000 and you failed to withdraw it, the penalty would be $5,000. This is a significant sum, designed to disincentivize non-compliance.

Corrective Action and Potential Waiver

If you realize you’ve missed an RMD, your immediate action should be to withdraw the missed amount as soon as possible. After you’ve taken the missed distribution, you then have the option to request a waiver of the penalty from the IRS.

Filing Form 5329

To request a waiver, you must file IRS Form 5329, “Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts.” On this form, you will declare the amount of the missed RMD and the amount of penalty tax. Crucially, you will also attach a letter of explanation.

Demonstrating Reasonable Cause

The IRS may waive the penalty if you can demonstrate “reasonable cause” for the missed RMD and prove that you have taken steps to remedy the shortfall. Reasonable cause could include a serious illness, a death in the family, or an administrative error by your financial institution. Simply forgetting is generally not considered reasonable cause. Your letter should clearly explain the circumstances, much like presenting your case to a judge, respectfully and with supporting evidence.

The IRS maintains the discretion to either grant or deny the waiver. While there’s no guarantee the penalty will be waived, acting promptly and providing a clear, reasonable explanation significantly increases your chances of a favorable outcome. Avoiding the 25% RMD penalty is not merely about ticking boxes; it’s about being informed, proactive, and meticulous in managing your retirement assets. By understanding the rules, leveraging available strategies, and acting decisively, you can ensure your hard-earned savings continue to work for you, rather than against you, throughout your retirement years.

FAQs

What is the 25 percent RMD excise tax penalty?

The 25 percent RMD excise tax penalty is a tax imposed by the IRS on individuals who fail to take their Required Minimum Distribution (RMD) from retirement accounts on time. It is calculated as 25 percent of the amount that was not withdrawn as required.

When do I need to take my Required Minimum Distribution (RMD)?

RMDs must generally be taken starting at age 73 (for those turning 72 after 2022) from most retirement accounts such as traditional IRAs and 401(k)s. The first RMD must be taken by April 1 of the year following the year you turn 73, and subsequent RMDs must be taken by December 31 each year.

How can I avoid the 25 percent RMD excise tax penalty?

To avoid the penalty, ensure you withdraw at least the minimum required amount from your retirement accounts by the deadline each year. Keep accurate records of your distributions and consult with a financial advisor or tax professional if you are unsure about your RMD requirements.

What should I do if I miss my RMD deadline?

If you miss your RMD deadline, you should take the missed distribution as soon as possible. You can file IRS Form 5329 to request a waiver of the penalty by explaining the reason for the missed RMD and showing that the shortfall was due to reasonable error and that you are taking steps to remedy it.

Are there any exceptions to the RMD rules that can help avoid the penalty?

Yes, certain exceptions exist, such as delaying RMDs if you are still working past age 73 and do not own more than 5% of the company sponsoring your retirement plan. Additionally, Roth IRAs do not require RMDs during the owner’s lifetime, so no penalty applies to those accounts.