As you look ahead to 2025, the landscape of Medicare is poised for significant changes that could reshape the way millions of Americans access healthcare. Medicare, a federal program designed to provide health coverage for individuals aged 65 and older, as well as certain younger individuals with disabilities, has been a cornerstone of American healthcare since its inception. With the aging population and rising healthcare costs, the program faces mounting pressure to adapt and evolve.

Understanding the intricacies of Medicare and the challenges it faces is essential for navigating the future of healthcare in the United States. As you delve deeper into the complexities of Medicare, it becomes clear that the program is not just a safety net for seniors but a vital component of the broader healthcare system.

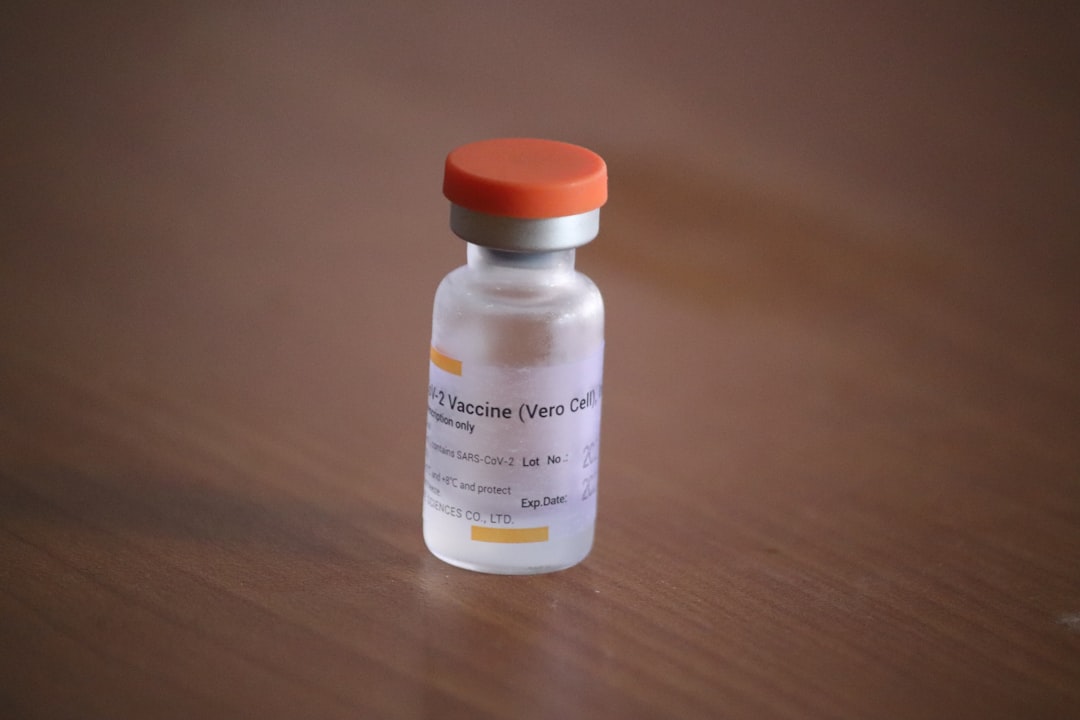

The ongoing discussions surrounding Medicare 2025 highlight the need for reforms that address both accessibility and affordability. With rising drug prices and an increasing number of beneficiaries relying on essential medications like insulin, the stakes have never been higher. This article will explore the historical context of Medicare, current challenges in prescription drug coverage, and the potential implications of proposed reforms, particularly the push for a $35 cap on insulin prices.

Key Takeaways

- Medicare has evolved over the years and faces challenges in providing coverage for prescription drugs.

- Rising insulin prices have a significant impact on Medicare beneficiaries, leading to a push for a insulin cap.

- Implementing a insulin cap in Medicare could benefit beneficiaries by making insulin more affordable.

- However, there are potential challenges and criticisms in implementing a insulin cap in Medicare.

- Pharmaceutical companies play a significant role in the debate over insulin pricing and Medicare coverage.

History of Medicare and its evolution

To fully appreciate the current state of Medicare, it is essential to understand its historical roots. Established in 1965 under President Lyndon Johnson’s Great Society initiative, Medicare was created to provide health insurance to older Americans who often faced financial barriers to accessing necessary medical care. Initially, the program offered two main components: Part A, which covers hospital insurance, and Part B, which covers outpatient services.

Over the years, Medicare has evolved to include additional components such as Part C (Medicare Advantage) and Part D (prescription drug coverage), reflecting the changing needs of its beneficiaries. As you consider the evolution of Medicare, it is important to recognize how societal shifts and advancements in medical technology have influenced the program. The introduction of Medicare Advantage plans in the 1990s allowed beneficiaries to receive their benefits through private insurance companies, offering more choices and flexibility.

Similarly, the addition of Part D in 2006 aimed to address the growing concern over prescription drug costs. However, these expansions have also led to increased complexity within the program, making it challenging for beneficiaries to navigate their options effectively.

Current challenges in Medicare coverage for prescription drugs

Despite its successes, Medicare faces significant challenges in providing comprehensive coverage for prescription drugs. One of the most pressing issues is the rising cost of medications, which has outpaced inflation and placed a heavy burden on beneficiaries. Many individuals on Medicare find themselves struggling to afford essential medications, leading to difficult choices between adhering to their treatment plans and managing their finances.

This dilemma is particularly acute for those with chronic conditions who rely on multiple prescriptions to maintain their health. As you explore these challenges further, it becomes evident that the structure of Medicare’s prescription drug coverage contributes to these issues. While Part D offers a range of plans with varying premiums and deductibles, beneficiaries often encounter high out-of-pocket costs, especially when they enter the “donut hole” coverage gap.

This gap can leave individuals responsible for a significant portion of their medication costs until they reach a certain spending threshold. The complexity of navigating these plans can lead to confusion and frustration among beneficiaries, exacerbating the difficulties they face in accessing necessary treatments.

The impact of rising insulin prices on Medicare beneficiaries

| Metrics | Data |

|---|---|

| Number of Medicare beneficiaries affected | Approximately 3.3 million |

| Percentage increase in insulin prices | Over 200% in the past decade |

| Out-of-pocket spending on insulin | Increased by 50% for Medicare beneficiaries |

| Impact on medication adherence | Decreased adherence due to cost concerns |

| Health outcomes | Increased risk of complications and hospitalizations |

Among the various medications that have seen dramatic price increases in recent years, insulin stands out as a particularly pressing concern for Medicare beneficiaries. For individuals with diabetes, insulin is not just a medication; it is a lifeline that enables them to manage their condition effectively. However, soaring prices have made it increasingly difficult for many beneficiaries to afford this essential drug.

As you consider the implications of rising insulin prices, it becomes clear that this issue extends beyond individual health; it has far-reaching consequences for public health and healthcare costs overall. The impact of rising insulin prices on Medicare beneficiaries is profound. Many individuals are forced to make difficult decisions about their health due to financial constraints.

Some may resort to rationing their insulin doses or skipping doses altogether, which can lead to severe health complications and even hospitalization. This not only jeopardizes their well-being but also places additional strain on the healthcare system as a whole. As you reflect on these challenges, it becomes evident that addressing insulin pricing is not just a matter of individual affordability; it is a critical public health issue that demands urgent attention.

The push for a $35 insulin cap in Medicare

In response to the growing crisis surrounding insulin affordability, there has been a concerted push for legislative action aimed at capping insulin prices for Medicare beneficiaries at $35 per month. This proposal has garnered significant support from advocacy groups, healthcare professionals, and lawmakers alike who recognize the urgent need for reform. By establishing a cap on insulin prices, proponents argue that it would alleviate financial burdens on beneficiaries and ensure that individuals with diabetes can access their necessary medications without fear of exorbitant costs.

As you consider the implications of this proposed cap, it is important to recognize that it represents more than just a financial solution; it symbolizes a broader commitment to addressing healthcare inequities. For many beneficiaries, a $35 cap could mean the difference between adhering to their treatment plans and facing dire health consequences due to unaffordable medication costs. This initiative reflects a growing recognition that access to essential medications should not be contingent upon one’s financial situation but rather be a fundamental right for all individuals.

The potential benefits of a $35 insulin cap for Medicare beneficiaries

Implementing a $35 cap on insulin prices could yield numerous benefits for Medicare beneficiaries and the healthcare system as a whole. First and foremost, such a cap would significantly reduce out-of-pocket expenses for individuals who rely on insulin to manage their diabetes. By providing predictable pricing, beneficiaries would have greater financial security and peace of mind when it comes to accessing their medications.

This could lead to improved adherence to treatment regimens and better health outcomes overall. Moreover, a $35 cap could alleviate some of the financial strain on Medicare itself. When beneficiaries are unable to afford their medications and experience complications as a result, they often require more extensive medical care, leading to increased costs for the program.

By ensuring that individuals can access their insulin without financial barriers, Medicare could potentially reduce hospitalizations and emergency room visits related to uncontrolled diabetes. As you contemplate these potential benefits, it becomes clear that implementing an insulin price cap could create a win-win situation for both beneficiaries and the healthcare system.

The potential challenges and criticisms of implementing a $35 insulin cap in Medicare

While the proposal for a $35 insulin cap has garnered widespread support, it is not without its challenges and criticisms. One significant concern revolves around how such a cap would be funded and whether it could lead to unintended consequences within the pharmaceutical market. Critics argue that capping prices may discourage innovation and investment in new diabetes treatments if pharmaceutical companies perceive reduced profitability in developing new products.

Additionally, there are concerns about how this cap would be implemented across different insurance plans within Medicare. The complexity of coordinating benefits among various providers could pose logistical challenges that may hinder timely access to insulin for beneficiaries. As you consider these potential obstacles, it becomes evident that while the goal of making insulin more affordable is commendable, careful planning and consideration are necessary to ensure that implementation does not inadvertently create new issues within the healthcare system.

The role of pharmaceutical companies in the debate over insulin pricing and Medicare coverage

Pharmaceutical companies play a pivotal role in the ongoing debate over insulin pricing and Medicare coverage. As you examine this issue more closely, it becomes clear that these companies have significant influence over drug pricing strategies and market dynamics. Many pharmaceutical manufacturers have faced criticism for setting exorbitant prices for life-saving medications like insulin while reaping substantial profits from their sales.

In recent years, some pharmaceutical companies have taken steps toward addressing public outcry over high insulin prices by introducing patient assistance programs or offering discounts directly to consumers. However, these measures often fall short of providing comprehensive solutions for all individuals who need access to insulin. As you reflect on this dynamic between pharmaceutical companies and Medicare beneficiaries, it becomes evident that meaningful change will require collaboration among stakeholders—including lawmakers, healthcare providers, and industry leaders—to create sustainable solutions that prioritize patient access over profit margins.

The potential impact of a $35 insulin cap on the healthcare industry

The implementation of a $35 insulin cap could have far-reaching implications not only for Medicare beneficiaries but also for the broader healthcare industry as a whole. If successful, this initiative could set a precedent for future pricing reforms across various classes of medications beyond just insulin. As you consider this potential ripple effect, it becomes clear that establishing price caps could encourage other sectors within healthcare to reevaluate their pricing structures and prioritize affordability.

Moreover, if more individuals can access their necessary medications without financial barriers due to an insulin price cap, there may be positive downstream effects on public health outcomes overall. Improved medication adherence could lead to lower rates of complications associated with diabetes management—ultimately reducing healthcare costs associated with emergency care or hospitalizations related to uncontrolled diabetes. As you contemplate these potential impacts on both patients and providers alike, it becomes evident that addressing drug pricing through initiatives like an insulin cap could represent a significant shift toward prioritizing patient-centered care within our healthcare system.

The future of Medicare and potential changes beyond 2025

Looking beyond 2025, the future of Medicare remains uncertain yet ripe with possibilities for reform and improvement. As you consider what lies ahead for this vital program, it is essential to recognize that ongoing discussions surrounding drug pricing will likely continue to shape its trajectory. Policymakers will need to grapple with balancing affordability while ensuring sustainable funding mechanisms are in place—especially as an aging population places increasing demands on healthcare resources.

Additionally, advancements in technology may play an integral role in shaping how Medicare operates moving forward. Telehealth services have gained traction during recent years—offering new avenues for delivering care while potentially reducing costs associated with traditional in-person visits. As you reflect on these trends within healthcare delivery models alongside ongoing efforts toward price reform initiatives like an insulin cap—it becomes clear that adaptability will be key in navigating future challenges facing both beneficiaries and providers alike.

Conclusion and outlook for Medicare beneficiaries and insulin coverage

In conclusion, as you navigate through the complexities surrounding Medicare 2025 and its implications for prescription drug coverage—particularly regarding insulin pricing—it is evident that significant changes are needed to ensure equitable access for all beneficiaries. The push for a $35 cap on insulin represents not only an urgent response to rising costs but also reflects broader societal values around healthcare equity and patient rights. While challenges remain in implementing such reforms effectively—collaboration among stakeholders will be crucial in driving meaningful change within our healthcare system moving forward.

As you look ahead toward 2025 and beyond—there is hope that continued advocacy efforts will pave the way toward improved access to essential medications like insulin—ultimately enhancing health outcomes for millions of Americans who rely on this vital treatment every day.

In light of the recent discussions surrounding the $35 insulin cap for Medicare beneficiaries set to take effect in 2025, it’s essential to stay informed about related healthcare topics. For more insights on senior health and the implications of such policies, you can read a comprehensive article on the subject at Explore Senior Health. This resource provides valuable information that can help seniors navigate their healthcare options effectively.

WATCH THIS 🛑 The Medicare Part D Lie That Steals Your $10,000 Drug Savings

FAQs

What is the $35 insulin cap for Medicare in 2025?

The $35 insulin cap for Medicare in 2025 is a policy that limits the out-of-pocket cost for insulin to $35 per month for Medicare Part D beneficiaries.

Who does the $35 insulin cap apply to?

The $35 insulin cap applies to Medicare Part D beneficiaries who are enrolled in a prescription drug plan that offers insulin coverage.

When will the $35 insulin cap for Medicare go into effect?

The $35 insulin cap for Medicare is set to go into effect on January 1, 2025.

How will the $35 insulin cap for Medicare impact beneficiaries?

The $35 insulin cap for Medicare will help reduce the financial burden on beneficiaries who rely on insulin to manage their diabetes by capping their out-of-pocket costs for this essential medication.

What is the purpose of implementing the $35 insulin cap for Medicare?

The purpose of implementing the $35 insulin cap for Medicare is to make insulin more affordable for Medicare beneficiaries and to ensure that they have access to the medication they need to manage their diabetes.