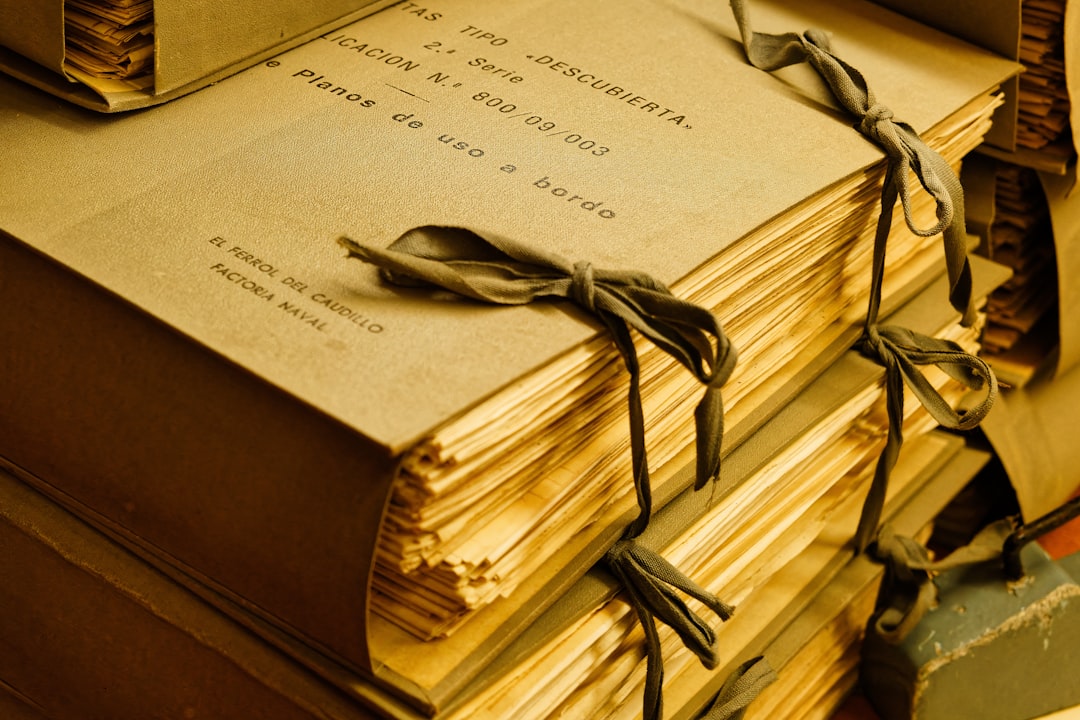

You stand at the precipice of understanding a critical aspect of personal preparedness: the meticulous organization and dissemination of your final wishes. This guide, akin to a blueprint for your legacy, details the components of a robust “Safeguard Stack” — a comprehensive collection of documents ensuring your intentions are honored when you can no longer articulate them. Consider this your navigational chart through the sometimes-murky waters of end-of-life planning. Ignoring these preparations is like leaving a ship without a captain; your journey, and the journey of those you leave behind, will be adrift.

The core of your Safeguard Stack comprises the legally binding documents that dictate your wishes. These aren’t merely suggestions; they are the architectural plans for your post-humous affairs. Without them, you expose your loved ones to uncertainty, potential disputes, and the often-protracted processes of intestacy laws. You can learn more about managing your funeral insurance premiums effectively by watching this informative video.

Last Will and Testament: Your Posthumous Voice

Your Last Will and Testament is the cornerstone of your estate plan. Think of it as your official decree, a legally enforceable declaration of how your assets will be distributed, who will care for your minor children, and who will manage the execution of these wishes.

Identifying Beneficiaries and Heirs

Within your Will, you explicitly name individuals or entities (beneficiaries) who will inherit your property. This granular level of detail, down to specific heirlooms or financial accounts, prevents ambiguity and potential familial discord. Consider the impact of a clear declaration versus the potential for arguments over sentimental items.

Appointing an Executor or Personal Representative

The Executor is the superintendent of your estate. This individual is legally responsible for gathering assets, paying debts and taxes, and distributing property according to your Will. Choosing a trustworthy, organized individual is paramount. Their role is to navigate the bureaucratic maze so your beneficiaries receive what you intended.

Guardianship for Minor Children

If you have minor children, your Will is the primary document for designating guardians. This is not merely a formality; it’s a profound act of parental responsibility. Without it, the state, not you, will decide who raises your children, potentially placing them with individuals you would not have chosen.

Trusts: Crafting a More Flexible Legacy

While a Will dictates distribution, a Trust provides a more versatile and often more immediate mechanism for asset management and transfer. It’s like building a specialized container for your assets, with detailed instructions on how and when its contents should be accessed.

Revocable Living Trusts: Maintaining Control

A Revocable Living Trust allows you to transfer assets into the trust during your lifetime, maintaining complete control over them. You can modify or revoke the trust at any time. Upon your death, the assets bypass probate, often expediting distribution and maintaining privacy. This is akin to pre-packaging your gifts, ready for immediate delivery without public inspection.

Irrevocable Trusts: Long-Term Protection and Tax Benefits

Irrevocable Trusts, once established, cannot be easily altered or dissolved. While you relinquish control over the assets you place within them, they offer significant benefits, including asset protection from creditors and potential estate tax advantages. These trusts act as a fortress, shielding your assets for designated purposes.

When it comes to ensuring that your final wishes are respected and carried out, having the right documentation in place is crucial. A related article that provides valuable insights on safeguarding stack final wishes documents can be found at Explore Senior Health. This resource offers guidance on how to effectively organize and communicate your preferences, helping to alleviate potential confusion for your loved ones during difficult times.

Navigating Incapacity: Your Voice in Times of Vulnerability

The Safeguard Stack extends beyond post-mortem planning to encompass periods when you may be alive but unable to make decisions for yourself. These documents are your emergency contact system, allowing your pre-determined wishes to guide your care.

Durable Power of Attorney: Financial and Legal Representation

A Durable Power of Attorney (DPOA) designates an agent to act on your behalf in financial and legal matters if you become incapacitated. This agent can manage bank accounts, pay bills, and make investment decisions, ensuring your financial obligations are met even when you cannot act for yourself.

General vs. Springing DPOA

A General DPOA grants immediate authority, while a Springing DPOA becomes effective only upon the occurrence of a specific event, typically your incapacitation, as certified by a physician. The choice between these depends on your comfort level with immediate delegation versus conditional activation.

Medical Aspects of a DPOA

While predominantly financial, some DPOAs can include provisions for healthcare decisions, though a separate Healthcare Power of Attorney is often preferred for clarity. Ensure your DPOA clearly delineates the scope of authority granted to your agent.

Healthcare Directives: Your Medical Compass

Healthcare Directives are your explicit instructions regarding medical treatment should you be unable to communicate your wishes. They are the lighthouse guiding your healthcare providers and loved ones through difficult medical decisions, preventing them from being swept away by uncertainty.

Living Will: Stating Your Treatment Preferences

A Living Will, often referred to as an Advance Directive, outlines your preferences for medical treatment, especially regarding life-sustaining measures. Do you wish to receive artificial hydration and nutrition? Do you want to be resuscitated? These are the critical questions a Living Will addresses.

Durable Power of Attorney for Healthcare (Healthcare Proxy)

This document designates an individual (your healthcare agent or proxy) to make medical decisions on your behalf if you are unable to. This agent acts as your voice, interpreting your Living Will and communicating your wishes to medical professionals. Their role is to ensure your medical journey aligns with your pre-established preferences.

HIPAA Release Form: Enabling Information Sharing

Without a HIPAA release form, healthcare providers are legally restricted from sharing your medical information, even with your designated healthcare agent or immediate family. This document acts as a key, unlocking vital medical information for those who need it to execute your wishes.

The Digital Legacy: Securing Your Virtual Footprint

In the 21st century, your “estate” extends far beyond physical assets. Your digital footprint — online accounts, social media profiles, digital assets — requires as much, if not more, attention than your tangible possessions. Neglecting this is like leaving valuable data unencrypted and unprotected.

Digital Asset Inventory: A Comprehensive Map

A digital asset inventory is a meticulously compiled list of all your online accounts, including usernames, passwords, and instructions for access or closure. This is your digital roadmap, guiding your loved ones through your virtual world.

Categorizing Digital Assets

Consider categorizing your digital assets: financial accounts (online banking, investment platforms), communication platforms (email, social media), intellectual property (blogs, websites, digital art), and digital files (photos, documents stored in cloud services). Each category may require different handling instructions.

Providing Access Instructions

Beyond usernames and passwords, include specific instructions for accessing or closing accounts. Do you want your social media memorialized, or deleted? Do you want specific digital files preserved or destroyed? These details provide clear direction.

Digital Executor Designation: A Specialized Role

Just as you appoint an executor for your physical estate, you can designate a “digital executor” to manage your digital assets. This individual is entrusted with the responsibility of upholding your wishes for your online legacy. Their role is to be the custodian of your digital persona.

Legal Considerations for Digital Assets

The legal landscape surrounding digital assets is still evolving. Some states have enacted “Revised Uniform Fiduciary Access to Digital Assets Act” (RUFADAA) laws, granting fiduciaries access to digital asset accounts. Familiarize yourself with the laws in your jurisdiction.

The Personal Dossier: Beyond the Legalities

While legal documents form the backbone, the Safeguard Stack also includes a “Personal Dossier” — a collection of non-legal yet incredibly important information that simplifies matters for those you leave behind. This is your user manual for your life, providing context and clarity.

Financial Accounts and Debts: A Clear Financial Picture

A comprehensive list of all financial accounts (bank accounts, investment accounts, retirement plans) and outstanding debts (mortgages, credit cards, loans) is invaluable. Include account numbers, contact information, and any relevant login details (stored securely). This prevents your loved ones from embarking on a financial scavenger hunt.

Insurance Policies

Detail all insurance policies, including life, health, auto, and home insurance. Provide policy numbers, insurer contact information, and beneficiary designations. This ensures that beneficiaries receive timely benefits and that coverage continues appropriately.

Employee Benefits

If you are employed, include information about your employer-sponsored benefits, such as life insurance, retirement plans, and any outstanding compensation or benefits. Your employer may offer resources or points of contact for your beneficiaries.

Personal Wishes and Messages: Your Enduring Voice

Beyond the legal and financial, there are personal wishes and messages that offer comfort and guidance to your loved ones. These are the soft touches, the emotional threads that connect you even after you’re gone.

Funeral and Burial Preferences

Detail your preferences for funeral arrangements, burial or cremation, memorial services, and any specific readings or music you desire. This alleviates the burden of decision-making for your family during a time of grief. This is your final choreography.

Ethical Wills (Legacy Letters)

An Ethical Will, or Legacy Letter, is not legally binding but offers a powerful way to convey your values, life lessons, blessings, and hopes for your loved ones. It’s a non-material inheritance, a spiritual and emotional testament.

Letters to Loved Ones

Consider writing individual letters to specific loved ones. These personal messages can provide comfort, resolve unresolved issues, or simply express your enduring love and gratitude. These are the whispers across time.

When planning for the future, it is essential to ensure that your final wishes are clearly documented and safeguarded. A related article on this topic can provide valuable insights into how to effectively manage these important documents. For more information on this subject, you can read the article on safeguarding your final wishes here. Taking the time to prepare these documents can bring peace of mind to both you and your loved ones.

Assembling and Maintaining Your Safeguard Stack: Vigilance and Accessibility

| Metric | Description | Value | Unit |

|---|---|---|---|

| Document Completion Rate | Percentage of final wishes documents completed using Safeguard Stack | 85 | % |

| Average Time to Complete | Average time taken to complete a final wishes document | 45 | minutes |

| User Satisfaction Score | Average user satisfaction rating for the document creation process | 4.7 | out of 5 |

| Number of Documents Created | Total final wishes documents created using Safeguard Stack | 12,500 | documents |

| Document Update Frequency | Average number of times a document is updated after initial creation | 2.3 | updates per document |

| Security Compliance | Percentage of documents stored with full encryption and compliance | 100 | % |

Creating your Safeguard Stack is not a one-time event; it is an ongoing process of assembly, review, and maintenance. Think of it as a living document, evolving with your life circumstances.

Secure Storage and Accessibility: The Vault of Your Legacy

The physical location of your documents is critical. A fireproof safe, a secure cloud storage solution, or a safety deposit box are common options. Crucially, ensure that designated individuals know where these documents are located and how to access them. This is the key to your vault.

Digital Security and Encryption

For digital documents and asset lists, prioritize strong encryption and multi-factor authentication. Share access information only with trusted individuals and ensure it is updated regularly. Your digital security is paramount.

Designating Trusted Individuals

Beyond those named in your legal documents, designate additional trusted individuals who know where your Safeguard Stack is located and whom to contact in case of an emergency. This creates redundancy and ensures accessibility.

Regular Review and Updates: A Living Document

Life changes — relationships evolve, financial situations shift, and laws are updated. Therefore, your Safeguard Stack requires periodic review and updates, ideally every 3-5 years, or whenever a significant life event occurs (marriage, divorce, birth of a child, major asset acquisition or disposition). Failing to update is like navigating with an outdated map.

Adapting to Life Changes

Marriage, divorce, birth, death, significant financial changes, or relocation to a different state all necessitate a review and potential revision of your documents. Ensure your Safeguard Stack reflects your current wishes and legal standing.

Staying Informed on Legal Developments

Laws regarding estate planning, healthcare directives, and digital assets are subject to change. Consult with legal professionals periodically to ensure your documents remain current and legally sound in your jurisdiction.

In conclusion, your Safeguard Stack is a testament to your foresight and love for those you leave behind. It is a comprehensive declaration of your wishes, a shield against uncertainty, and a final act of care. By meticulously assembling and maintaining these documents, you provide a clear path for your legacy, ensuring that your journey, and the journey of your loved ones, is as smooth and undisturbed as possible. Do not delay in constructing this vital framework; the time to build your Safeguard Stack is now.

WATCH THIS 🔥WARNING: The Funeral Insurance Trap Agents Hide (76% Never Pay Out)

FAQs

What are final wishes documents?

Final wishes documents are legal papers that outline a person’s preferences regarding their estate, funeral arrangements, healthcare decisions, and other personal matters after their death.

Why is it important to safeguard final wishes documents?

Safeguarding these documents ensures that a person’s wishes are honored, prevents disputes among family members, and provides clear instructions to executors and healthcare providers.

Where should final wishes documents be stored?

They should be stored in a secure, accessible location such as a fireproof safe, a safety deposit box, or with a trusted attorney or executor. It’s important that designated individuals know where to find them.

Who should have access to final wishes documents?

Access should be granted to trusted family members, executors, legal representatives, and healthcare proxies to ensure the documents can be used when needed.

How often should final wishes documents be updated?

Final wishes documents should be reviewed and updated regularly, especially after major life events such as marriage, divorce, the birth of a child, or significant changes in financial status or health.