Medicaid penalty period calculation is a crucial aspect of understanding how eligibility for Medicaid benefits is determined, particularly for long-term care services. When an individual applies for Medicaid, the state assesses their financial situation to determine if they meet the necessary criteria. If it is found that the applicant has transferred assets or income in a way that is deemed non-compliant with Medicaid regulations, a penalty period may be imposed.

This penalty period essentially delays the applicant’s eligibility for benefits, which can have significant implications for those needing immediate care. The calculation of this penalty period is based on the value of the assets transferred and the state’s specific rules regarding asset limits. Each state has its own methodology for determining the length of the penalty period, often using a formula that divides the total value of the transferred assets by a predetermined daily rate.

This means that if you have made gifts or sold assets below market value within a certain timeframe before applying for Medicaid, you could face a delay in receiving benefits. Understanding this calculation is essential for anyone considering Medicaid as a means to cover long-term care costs.

Key Takeaways

- Medicaid penalty periods result from asset transfers made to qualify for benefits and delay eligibility.

- The look-back period reviews asset transfers, typically covering the past 5 years before applying for Medicaid.

- Certain transfers are exempt, such as those to a spouse or disabled child, and do not trigger penalty periods.

- Penalty periods are calculated by dividing the total uncompensated value of transferred assets by a monthly penalty divisor.

- Professional Medicaid planning and appeals can help minimize or challenge penalty periods to protect eligibility.

Who is Subject to Medicaid Penalty Periods?

Individuals who are seeking Medicaid benefits for long-term care services are typically subject to penalty periods. This includes seniors who may require nursing home care or other forms of assisted living. However, it’s not just the elderly who can find themselves facing these penalties; younger individuals with disabilities or chronic illnesses may also be affected.

If you or a loved one has transferred assets within the look-back period—usually five years prior to applying for Medicaid—you may be subject to a penalty period that could delay your access to necessary care. Moreover, it’s important to note that penalty periods can also apply to spouses of applicants. If one spouse applies for Medicaid while the other retains assets, any improper transfers made by either spouse can impact eligibility.

This means that both partners must be aware of how their financial decisions can affect their Medicaid application. Understanding who is subject to these penalties is vital for effective planning and ensuring that you or your loved ones can access the care needed without unnecessary delays.

Understanding the Look-Back Period

The look-back period is a critical component in determining Medicaid eligibility and calculating penalty periods. This period typically spans five years prior to the date of your Medicaid application. During this time, any asset transfers made for less than fair market value are scrutinized by Medicaid officials.

If you have given away money or property, sold assets at a discount, or otherwise transferred wealth in a way that could be seen as an attempt to qualify for Medicaid, these actions will be examined closely. Understanding the look-back period is essential because it sets the stage for what constitutes an improper transfer. If you are planning to apply for Medicaid, it’s wise to review your financial history during this five-year window.

Any transfers made during this time could potentially lead to a penalty period, affecting your eligibility for benefits. Being proactive and aware of these regulations can help you make informed decisions about asset management and ensure that you are prepared when it comes time to apply for assistance.

How Assets and Income Affect Penalty Period Calculation

| Factor | Description | Impact on Penalty Period | Example |

|---|---|---|---|

| Countable Assets | Assets considered in the calculation, excluding exempt assets like primary residence | Higher countable assets increase the penalty period length | 50,000 in countable assets results in a longer penalty period than 20,000 |

| Income | Monthly income that may be used to pay for care | Higher income can reduce the penalty period if it is applied to care costs | Monthly income of 3,000 reduces penalty period compared to 1,000 |

| Penalty Period Calculation | Determined by dividing total countable assets by average monthly cost of care | More assets or lower care costs lengthen the penalty period | 100,000 assets / 5,000 monthly care = 20 months penalty |

| Exempt Assets | Assets not counted in penalty calculation (e.g., primary home, personal belongings) | Exempt assets do not affect penalty period length | Primary residence valued at 150,000 excluded from calculation |

| Asset Spend-Down | Process of reducing assets to qualify for benefits | Reduces countable assets, thereby shortening penalty period | Spending down from 80,000 to 30,000 reduces penalty months |

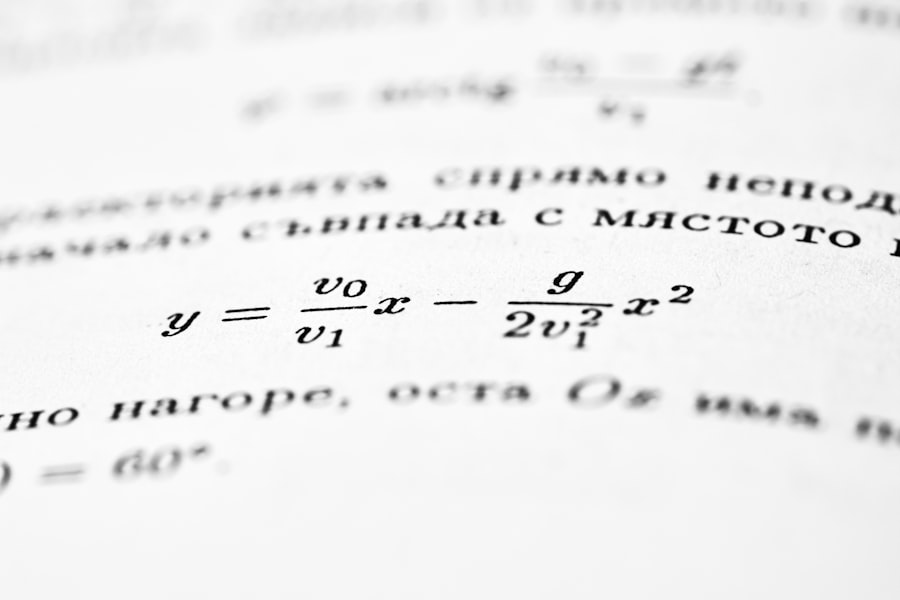

When calculating the penalty period, both assets and income play significant roles in determining eligibility for Medicaid benefits. The value of any assets transferred during the look-back period is assessed to establish whether they were given away or sold below market value. The total value of these assets is then divided by the state’s average daily cost of nursing home care to calculate the length of the penalty period.

This means that if you have transferred substantial assets, you could face a lengthy delay in receiving benefits. Income also factors into this equation, although it is treated differently than assets. While assets are evaluated based on their value at the time of transfer, income is assessed based on your current financial situation at the time of application.

If your income exceeds Medicaid’s allowable limits, it may affect your eligibility regardless of your asset situation. Therefore, understanding how both assets and income interact in the context of Medicaid eligibility is crucial for anyone navigating this complex system.

Exempt Transfers and Penalty Periods

Not all asset transfers result in a penalty period; some transfers are considered exempt under Medicaid rules. Exempt transfers include gifts made to certain family members, such as spouses or disabled children, as well as transfers made for specific purposes like paying for medical expenses or purchasing a primary residence. These exemptions are designed to allow individuals to support their loved ones without jeopardizing their eligibility for Medicaid benefits.

However, it’s essential to understand that while some transfers may be exempt, they still need to be documented properly to avoid complications during the application process. If you believe that certain transfers fall under exempt categories, it’s wise to keep thorough records and consult with a professional who understands Medicaid regulations. This can help ensure that you are not inadvertently creating issues that could lead to a penalty period when applying for benefits.

Calculating the Penalty Period

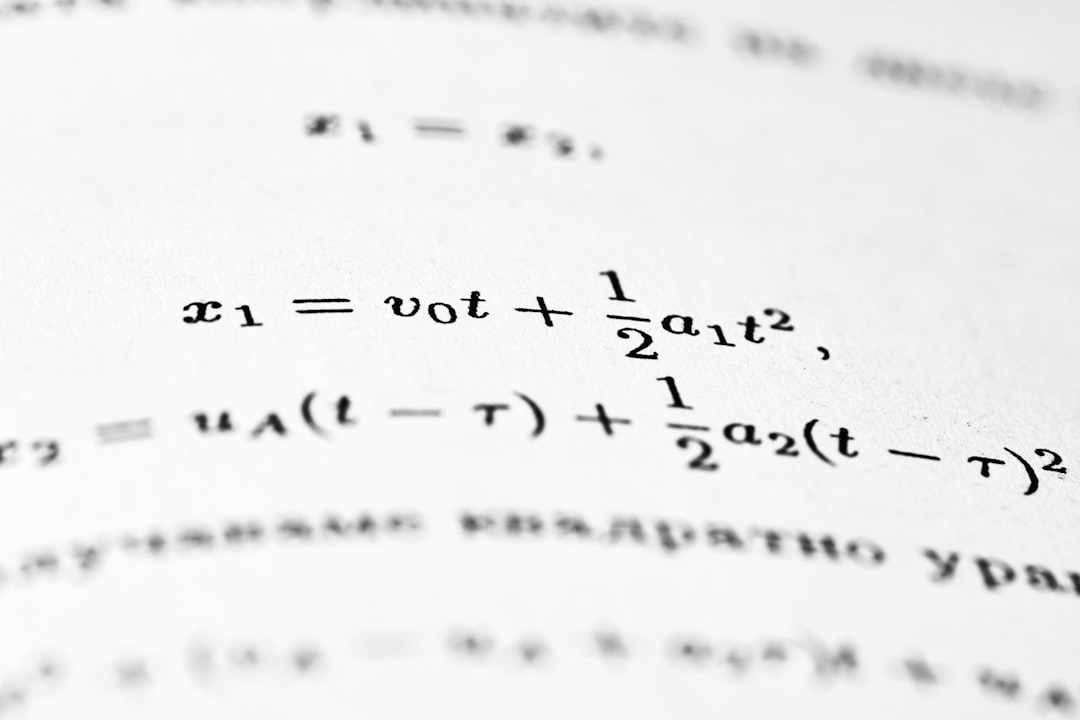

Calculating the penalty period involves a straightforward formula but requires careful attention to detail regarding asset transfers. To determine the length of the penalty period, you take the total value of all non-exempt assets transferred during the look-back period and divide that amount by your state’s average daily cost of nursing home care. For example, if you transferred $60,000 worth of assets and your state’s average daily rate is $200, your penalty period would be 300 days.

It’s important to note that this calculation can vary significantly from state to state due to differences in average daily rates and regulations surrounding asset transfers. Therefore, if you are navigating this process, it’s crucial to familiarize yourself with your state’s specific rules and rates. Additionally, keep in mind that any changes in your financial situation or new asset transfers after your initial calculation could impact your penalty period and overall eligibility.

Appealing Penalty Period Decisions

If you find yourself facing a penalty period that you believe is unjustified, you have the right to appeal the decision made by Medicaid officials. The appeals process typically involves submitting a formal request for reconsideration along with any supporting documentation that demonstrates why you believe the penalty should be lifted or reduced. This may include evidence of exempt transfers or proof that certain assets were not improperly transferred.

Navigating the appeals process can be complex and often requires a thorough understanding of Medicaid regulations and procedures. It’s advisable to seek assistance from professionals who specialize in Medicaid appeals to ensure that your case is presented effectively. By taking this step, you can advocate for yourself or your loved one and potentially reduce or eliminate an undeserved penalty period.

Strategies for Minimizing Penalty Periods

To minimize potential penalty periods when applying for Medicaid, proactive planning is essential. One effective strategy is to engage in early estate planning, which involves making informed decisions about asset transfers well before entering the look-back period. By understanding what constitutes an exempt transfer and structuring your financial affairs accordingly, you can protect your assets while ensuring eligibility for benefits.

Another strategy involves consulting with professionals who specialize in Medicaid planning. These experts can provide guidance on how best to manage your assets and income while remaining compliant with Medicaid regulations. They can help you navigate complex rules and identify opportunities for exempt transfers that won’t trigger penalties.

By taking these steps early on, you can significantly reduce the risk of facing lengthy delays in accessing necessary care.

Impact of Penalty Periods on Eligibility for Medicaid Benefits

The impact of penalty periods on eligibility for Medicaid benefits cannot be overstated. When a penalty period is imposed, it effectively delays your access to critical healthcare services that may be needed immediately. For individuals requiring long-term care, such as nursing home services or assisted living arrangements, this delay can lead to significant financial strain and emotional distress for both the individual and their family members.

Moreover, understanding how penalty periods affect eligibility is vital for effective planning. If you are aware that certain actions could lead to penalties, you can make more informed decisions about asset management and financial planning well in advance of applying for Medicaid benefits. This foresight can help ensure that you or your loved ones receive timely access to necessary care without unnecessary complications.

How Medicaid Planning Can Help with Penalty Periods

Medicaid planning plays a pivotal role in helping individuals navigate potential penalty periods effectively. By engaging in comprehensive planning strategies, you can structure your finances in a way that minimizes risks associated with asset transfers and ensures compliance with Medicaid regulations. This may involve creating trusts, making strategic gifts, or utilizing other financial tools designed to protect your assets while still qualifying for benefits.

Additionally, Medicaid planning can provide peace of mind by clarifying what actions are permissible under current laws and regulations. With expert guidance, you can develop a tailored plan that addresses your unique circumstances and needs while safeguarding your eligibility for essential healthcare services. By taking proactive steps through Medicaid planning, you can significantly reduce the likelihood of encountering penalties when applying for benefits.

Seeking Professional Advice for Medicaid Penalty Periods

Navigating the complexities of Medicaid penalty periods can be daunting without professional assistance. Seeking advice from experts who specialize in elder law or Medicaid planning can provide invaluable insights into how best to approach your situation. These professionals understand the intricacies of state regulations and can help you develop strategies tailored to your specific needs.

Whether you are facing an impending application or dealing with an existing penalty period, professional guidance can make all the difference in ensuring compliance and protecting your interests. By working with knowledgeable advisors, you can gain clarity on your options and take informed steps toward securing necessary healthcare services without unnecessary delays or complications.

For those looking to understand the intricacies of Medicaid penalty period calculations, a helpful resource can be found in the article on senior health topics at Explore Senior Health. This site provides valuable insights into various aspects of Medicaid, including eligibility requirements and the implications of asset transfers, which are crucial for accurately determining penalty periods.

WATCH THIS! The 5-Year Gift Trap That Lets Medicaid Legally Steal Your Home

FAQs

What is a Medicaid penalty period?

A Medicaid penalty period is a timeframe during which an individual is ineligible to receive Medicaid long-term care benefits due to the transfer of assets for less than fair market value. This penalty is imposed to prevent individuals from giving away assets to qualify for Medicaid.

How is the Medicaid penalty period calculated?

The Medicaid penalty period is calculated by dividing the total value of the transferred assets by the average monthly cost of nursing home care in the applicant’s state. The resulting number represents the number of months the individual will be ineligible for Medicaid coverage.

What is the formula for Medicaid penalty period calculation?

The general formula is:

**Penalty Period (months) = Total Value of Transferred Assets ÷ Average Monthly Cost of Nursing Home Care**

What counts as a transferred asset for Medicaid penalty purposes?

Transferred assets include any property, money, or resources given away, sold below market value, or otherwise disposed of without receiving fair compensation within the look-back period (usually 60 months before applying for Medicaid).

What is the Medicaid look-back period?

The look-back period is the timeframe during which Medicaid reviews an applicant’s financial transactions to identify any asset transfers that could trigger a penalty. It typically covers the 60 months (5 years) prior to the Medicaid application date.

Can the penalty period be shortened or waived?

In some cases, the penalty period may be shortened or waived if the applicant can demonstrate that the asset transfer was made for a purpose other than qualifying for Medicaid, or if it caused undue hardship.

Does the Medicaid penalty period affect all Medicaid benefits?

No, the penalty period generally applies only to long-term care benefits such as nursing home care. The individual may still be eligible for other Medicaid services during the penalty period.

How can one avoid a Medicaid penalty period?

Avoiding a penalty period involves careful planning, such as legally transferring assets well in advance of applying for Medicaid, using trusts, or spending down assets on allowable expenses. Consulting with an elder law attorney is recommended.

Is the average monthly cost of nursing home care the same in every state?

No, the average monthly cost of nursing home care varies by state and is updated regularly. Medicaid uses the state-specific average cost to calculate the penalty period.

Where can I find the average monthly cost of nursing home care for Medicaid calculations?

The average monthly cost is typically published by state Medicaid agencies or can be obtained through state health departments or elder care resources. Some states provide this information on their official Medicaid websites.